A lesson in controlling the narrative by WiseTech Global.

Very few companies excel at writing their own story in today's highly mediatized and ever-scrutinized world. Yet somehow, this Australian logistics technology company has once again crafted an intricate storyline for the next financial year, and the markets are loving it.

But when you read between the lines, beyond the numbers and fancy announcements, what is the full story?

Does it start to feel like a thread is slowly unravelling as a company celebrating 30 years of growth and innovation, struggles to decide on the direction to take moving forward. Or are they setting things up nicely for the next phase of their growth?

"Numbers don't lie, people do."

First, the elephant in the room: a small $414 million (USD) acquisition that hasn't delivered. Back when WiseTech acquired Blume Global, they described it as a "high-growth recurring revenue business" that was "expected to generate FY24 revenues in the range of US$65 million" on the low end. So an expected annual growth of about 45%.

Either Pervinder Johar is a top 0.1% salesman or somebody dropped the ball somewhere along the M&A process, but we're not seeing that growth. In fact, 45% looks more like single digits. The good news is that WiseTech can afford to take their time figuring out how to handle the mess that is landside logistics and the Envasé x Blume Global acquisitions. Why? Because they've gone and found new ways to essentially guarantee they hit their guidance for FY25, reducing this operation to nothing more than a blip, in the grand scheme of things.

It is highly doubtful that WiseTech Global will attempt opportunistic acquisition of this scale in the future, let alone two. Fail fast, fail hard, learn from your mistakes, and move on.

Who mentioned a global customs product?

The darling of previous results announcements and investor decks, the customs product barely got a mention this time around. The lack of updated functionality scope for the customs product leads me to believe that they haven't made much progress. All we get this time around is the mention that "significant future growth is expected" from the customs product, alongside landside and warehousing.

Considering that Richard White has publicly stated that customs makes up 50% of their development efforts, this is rather concerning and raises a number of questions:

- Have they reorganized resources to move some focus away from the customs product?

- Are they still having issues with some key countries (Germany, Brazil)?

- Is there an issue with taking the product to market as standalone?

- Are target prospects willing to pay?

Since the announcement that Kuehne+Nagel were rolling-out the customs functionality globally, we haven't heard much. The same goes for adoption of the functionality by existing Cargowise users. Considering the M&A and dev investment put into the customs product specifically, it would be nice to hear more. I expect the global customs solution to take a leading role in a future presentation.

Renewed focus on global logistics services providers.

I've been vocal about WiseTech needing to start pushing into the BCO space for a while now, and I believe that they will do so. The announcements made last week were done with carefully curated words designed to reassure their existing customer base. But stating that there is no intention to "aggressively sell to BCOs" and pursuing inbound opportunities aren't mutually exclusive.

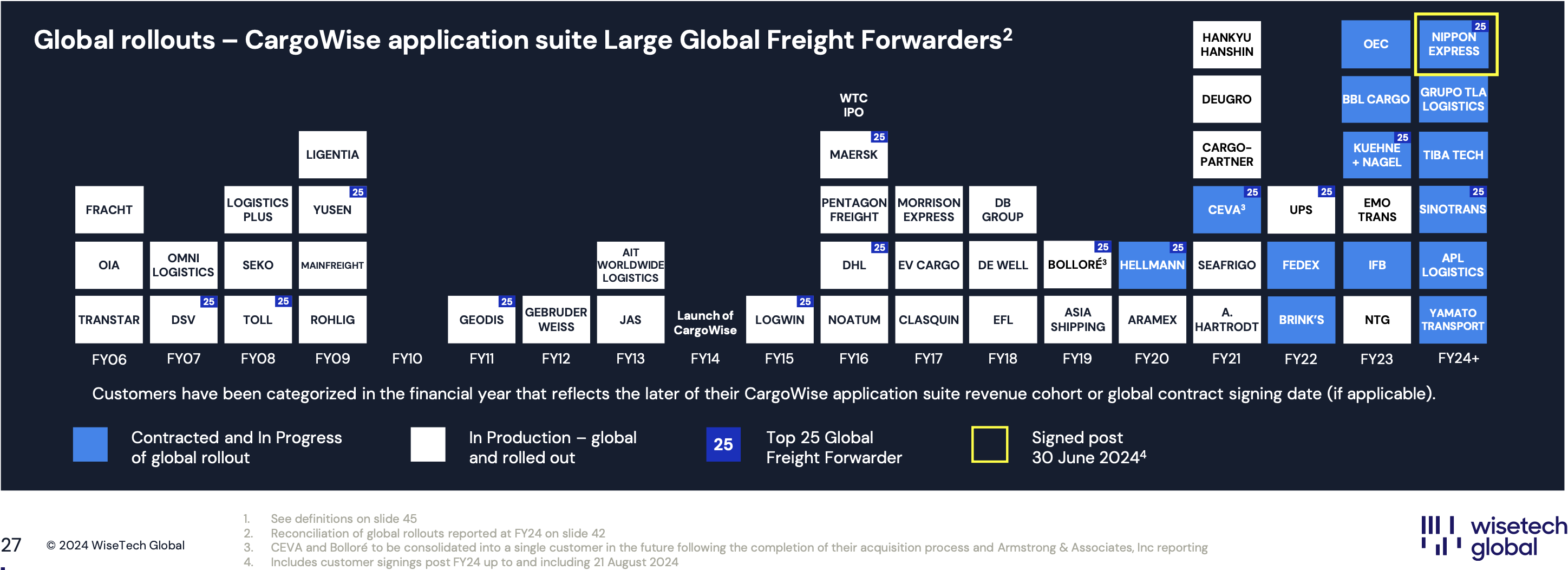

When looking at the global forwarding market, you cannot help but feel that further potential and reach for WiseTech is "limited". The scope and scale of their product has seen them become the go-to option for the top 50 global logistics services providers. The other side of that coin is that they've alienated themselves from the majority of the long tail market due to successive price increases (a natural and necessary evolution). The move away from the long tail forwarding market has been gradual, with many now looking for alternative options with less functionality, at much cheaper price points. At the end of the day, this had to happen. Freight forwarding is top heavy, and with the concentration of volumes amongst the top 50, that is where you need to focus your efforts when searching for the kind of growth WiseTech has become accustomed to.

However, there are limits to what can be achieved, even at the top. Sure, they can suggest a strong pipeline on the back of announcing Nippon Express as a customer. But at the end of the day, Nippon Express signed after failing an in-house development project incurring losses exceeding US$100 million. Speaking of Nippon Express, the idea of an accelerated global rollout is both exciting and daunting. The approach feels rushed, and with the majority of the outcome weighing on the third-party partner network and Nippon Express' internal resources, it doesn't seem like something WiseTech should be encouraging.

A quick note on DB Schenker

If DSV manages to acquire DB Schenker, beating CVC to the prize, this will be another great win for WiseTech. It should also lock DSV into using Cargowise for a longer period of time, with the tech being a key part of their strategy to turn acquired business into productivity powerhouses. They've done it with Panalpina and Agility, why not go again?

Which would be the be the better home for DB Schenker employees? Neither option is perfect. On the one hand, DSV are known for letting people go post acquisition. On the other, CVC will do everything that they can to turn their investment into a lucrative exit opportunity down the line. Personally? I'd rather see DSV become the world's number 1, forcing Kuehne+Nagel to make bold moves, rather than have CVC sell Schenker for parts to make a profit in 2030.

Between Nippon Express and DB Schenker, this could represent a further revenue increase of 5-6% for WiseTech once fully live, should the Schenker deal close quickly, and the Nippon Express rollout go without any hiccups.

What about Kuehne+Nagel?

I mentioned Kuehne+Nagel's customs global rollout earlier and how we're still waiting for any update. But what about a potential Cargowise global rollout replacing internal systems?

When sitting at the top of the global freight forwarding charts, you know that others are gunning for your spot. Without change and constant improvement, the only way is down. K+N have acknowledged this. I won't go into too much detail here, maybe in another newsletter, but I appreciate their approach. Restructuring, acquisitions, closer customer relationships, and... "enhancing digital platforms and leveraging technology to improve logistics solutions."

After cost-cutting, the name of the game is cost management. Controlling costs when developing your own technology is notoriously difficult, especially in a highly competitive tech environment. If WiseTech can get their customs ducks in a row, it is the perfect appetizer for K+N, who, if serious about cost management, may just have to consider implementing Cargowise after all. And that is without factoring in the potential jump in functionality improvements and productivity gains that Cargowise claims to yield for its customers.

One to watch.

Are the limits really... limits?

I started this section on LSPs talking about limits. The truth is, when your pipeline still contains a healthy number of top 50 global logistics services providers, is this really limiting?

Its hard to imagine a world where Cargowise Next is used by EVERY top 50 global logistics services provider, but at the same time, they are winning new business, and retaining existing customers. There have been no huge technological breakthroughs, nor do any seem to be on the horizon, and frankly, the competition seems to have all but given-up on delivering a true product for the top-end. I don't blame them, the scale is huge, and by the time they finish development and have a product ready to go to market, the role of the global LSP may be quite different.

Three new "products".

The "next generation platform" is here: "CargoWise next". WiseTech decided to continue along their well established pattern of releasing new platforms every decade. And just as ediEnterprise became CargoWise One, CargoWise One becomes CargoWise next.

What does this mean for those using the product? A forced change onto the new platform to benefit from all the new functionality. Functionality which conveniently includes the other two new big releases: Container Transport Optimization and ComplianceWise.

Fortunately for existing users, this forced upgrade will not come with a price increase, which frankly would have been a bit much even by WiseTech's standards after the 5% price increase that hit existing customers on July 1st. Unfortunately for everyone, during the Q&A segment of the earnings call, Siraj Ahmed from Citigroup asked a question which leads me to believe that WiseTech already know exactly how much they will make from these two new "products".

CargoWise next may retain the same price point as CargoWise One, for the same functionality, but this doesn't apply to new modules. WiseTech also have a history of imposing price increases for various reasons, some fair, some rather borderline. When the forwarders were making huge profits with jacked-up rates and capacity issues, WiseTech used inflation and high production costs to increase prices. Fair enough.

But the price increases that we do not always think about are those linked to price list changes or new mandatory functionality. Its a grey area that I prefer not to talk about too much, as WiseTech have always frowned-upon detailed public discussions of their pricing. But every customer knows that it is an established pattern, which can lead to substantial increases to annual costs.

"But Anthony, Container Transport Optimization and ComplianceWise are new products, of course they'll come at a cost." - What if I told you that this cost could become mandatory? There are 2 reasons that lead me to this assumption, aside from the fact that WiseTech know how to leverage new functionality to increase revenue.

Catch last week's newsletter and hear my thoughts about why the past few years of investment have been wasted.

1 - The numbers

Remember, the numbers never lie, but people do. Well, in this case, nobody has lied, but the narrative being spun is vague. Based on guidance, the lack of any immediate revenue from new customers early in their rollouts, and the expected rate of organic growth... WiseTech need to come up with some new revenue from CargoWise next, Container Transport Optimization, and ComplianceWise.

The outgoing CFO Andrew Cartledge, has said that CargoWise Next "doesn't have a step-up in price" and that "it is sold at effectively the same price". In order for them to keep their word, the other 2 products will need to do the heavy lifting. Now I'd like to believe that these products are going to be amazing enough that every customer will use them willingly.

But why take that risk when you can just bill them anyway, regardless of usage?

2 - They are modules

During the Q&A segment of the results call, Siraj Ahmed from Citigroup asked a question about the new products and where the new revenue growth will be coming from. When answering this question, Richard White said that "there would be more revenue from CargoWise One modules, including Container Transport Optimization and ComplianceWise."

Again, I do hope that I am wrong, but these modules, especially ComplianceWise, have the potential to become standard functionality, and to be billed as such.

Before moving on and for the sake of fairness and clarity, I do want to point out that during the same answer, Richard went on to mention growing through new customers, as well as other levers, and that they grow on all the metrics. I do not disagree with that statement, but again, in order for them to hit their guidance for FY25, the new products/modules will need to deliver in a big way.

ComplianceWise will have a huge impact

Whether costly surprises due to misinformed decision making or just "the cost of doing business", compliance fines are the real deal and things are about to go to a new level. Eric Johnson published two articles in as many days this month, including this one, suggesting the onus is more and more on customs brokers to ensure compliance.

It isn't their responsibility yet, but being able to guarantee compliance through great Know Your Cargo (KYC) solutions is the next competitive advantage for customs brokers and forwarders alike. WiseTech's ComplianceWise aims to do just that, and their current reach may just blow everyone out of the water.

Here's the deal forwarders such as Toll have been fined in the past for non-compliance relating to payments rather than shipment compliance. Many others have been fined for similar reasons, transporting sanctioned cargo, or receiving payment from the wrong entity. These fines are usually unexpected, and the amounts unpredictable. But as the US and Europe start to fight trade wars both due to dreadful geopolitical conflicts and an attempt to remain competitive, this situation will expand.

Altana recently raised US$200 million, reaching unicorn status. What if I told you their entire addressable market just shrank overnight? This may come across as slightly dramatic, but when the likes of DSV and Kuehne+Nagel start talking about being closer to their clients, it doesn't take much to read between the lines and understand what is at play here.

If WiseTech choose to make ComplianceWise mandatory paid functionality in CargoWise next, their entire customer base will not look elsewhere, which is not the case for other areas such as customs or visibility. Why? Because if ComplianceWise isn't 100% compliant, then WiseTech are the ones in the hot seat. Why pay for another compliance solution when your provider is already charging you for a solution that you know has to be compliant anyway?

What does this mean for the independent KYC and other compliance players in the market? They've just lost the likes of DHL, DSV, Ceva x Bolloré, Geodis, Nippon Express, and more, as potential clients. The thing is, it doesn't stop there... And this is where it gets very, very interesting.

If forwarders are paying for this compliance anyway, they may as well offer it as part of their services to their customers, either as a paid addition, or to sweeten volume-contract negotiations. Either way, we can imagine that a healthy percentage of BCOs working with CargoWise next using forwarders will lean on their LSPs for compliance. Especially if this leaves them on the hook for noncompliance issues. Brilliant.

There is plenty more I would like to cover in this newsletter, such as the Container Transport Optimization solution, the implications of eAdaptor Next, if CargoWise is well positioned to dominate the electronic Bill of Lading space (spoiler alert, they aren't), and what is hiding behind Cargo Visibility API.

There is also plenty to explore around how WiseTech can start serving the BCO market and gaining brand recognition there without alienating their existing customer base, which seems like an impossible, yet necessary task, should they want to pursue growth for the foreseeable future.

Plenty of that, and more, in a future newsletter.

Want more? Click the image below to access my LinkedIn profile and send me a connection request or follow for more content.

If you've made it this far, thank you for reading all the way. If you enjoyed the newsletter, please suggest it to others, every subscription (free) really helps with the reach.

And if you really liked it, head over to LinkedIn and read some more, and drop a like or comment on my most recent posts - it all feeds the algorithm monster!