From Controlling The Narrative to Losing The Room.

WiseTech Global, leading freight forwarding software provider, seems to be struggling to keep its word after making some bold announcements in 2024.

Freight forwarding technology leader WiseTech Global is going through a rough patch. Actually it is going through rough patches. Is this the beginning of a decline?

There are those of you who will read this and think “the stock price is up over the past 6 months, even in the face of adversity, what is Anthony going on about now?”. Zoom out a further 6 months and the stock is up nearly 65%. But valuations are just that. They are the perceived value of a company by those willing to invest their money into the company in the hope of an increased valuation in the future. Let's leave the stock price aside for a moment and talk about context, reality, and sentiment.

WiseTech Global is no Longer Reliable.

Back in August of 2024, I published an article about WiseTech Global controlling the narrative. You'll find a link to it below, be sure to check it out now for context before reading further, as the change of tone and outlook between that article and this one perfectly illustrates how quickly things can change in the logistics technology world.

Welcome back, did you enjoy the article? Didn't bother reading it? Don't worry, I'll summarize it quickly for you here: WiseTech Global pulled a narrative masterclass by announcing three new “products” and great guidance for the year ahead, without addressing any of the major problems that it has brought upon itself. You can't really blame the PR team or leadership, not a single “investor” asked the right questions during the Q&A either. This shows how disconnected investors, and valuation, can be from the reality of a business and the perception the market and its customers have of it.

Set Expectations and Meet Them - The Old WiseTech Way

As many of you know, I worked at WiseTech Global from 2014 to 2021. Back then, Founding CEO turned Consultant Richard White, who was the CEO at the time (more on that later), taught me some principles that I still use today. There was one thing in particular that he told me during a meeting that has always remained stuck in my head. I do not remember the exact quote, but it was along the lines of “set the right expectations and meet them”. Oh WiseTech, when did you lose your way?

Since then, we've seen multiple examples of WiseTech Global leadership making announcements designed to excite investors and wow customers, without delivering in a timely manner. Remember when NEO was first announced? Neither do I. But I do remember an annual results presentation where WiseTech Global claimed that NEO would be rolling out that very year and replacing the legacy web tracker platform… Yeah, that never happened.

Fast forward to 2024 and WiseTech made its big 30 year anniversary announcement: CargoWise Next is coming. Now here is where things get slightly confusing: CargoWise Next was announced in August 2024, with the rollout starting in Q2 25, which was October 2024. Furthermore, a fair chunk of the FY25 guidance appeared dependent on the new product and two of its core components: Container Transport Optimization and ComplianceWise.

We are now in January 2025, over half way through FY25, and CargoWise Next is nowhere to be seen. So much for setting expectations and delivering.

Listen to What we Say, Ignore What we do

If you are just a passer-by here, or maybe have just started taking an interest in logistics technology, you may have missed the events that unfolded late last calendar year. I will not lower myself to the same level that most media outlets chose in order to whip-up a media frenzy around the events. You can find my focus on the business implications in the below newsletter I posted on LinkedIn back in October last year.

The conclusion of those events was that WiseTech Global would find a new CEO, and that the outgoing CFO Andrew Cartledge will be stepping into the role of interim CEO. I know this was only 3 months ago, but the fact that NOTHING seems to have happened since then is just a continuation of WiseTech's usual pattern of behavior. I'm not upset at the fact that they do not have a new CEO, these things take time. I am frustrated that they set the expectation of new leadership, which appears to be an impossible task when you consider just how much of the company Richard White owns.

WiseTech is Only Competitive if…

Imagine paying for the most expensive product on the market.

Now imagine that they are perpetually increasing your price point.

However they promise more functionality baked into the product to compensate.

But that functionality arrives late, is incomplete, releases in a subpar state and takes a while to settle.

Are you getting a good deal?

This appears to be the reality of CargoWise today, and it is a sad reality. Price increases come thick and fast, with various excuses being used such as “inflation” and “new core functionality”. But the truth appears to be much less interesting than that. The price increases happen, simply because they can.

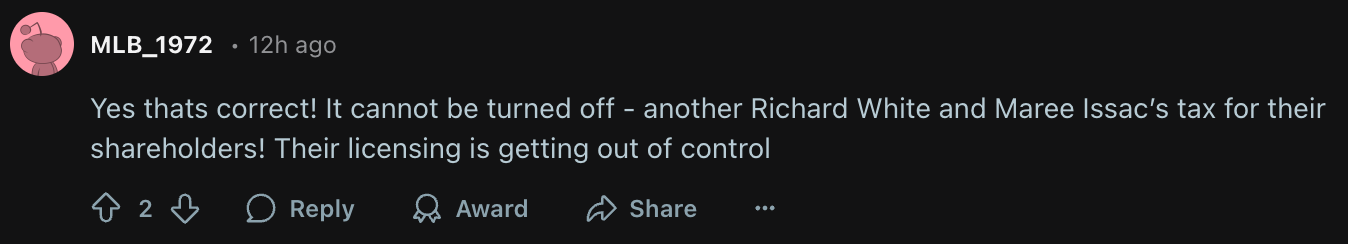

The Price List Lever is a WiseTech Global Addiction

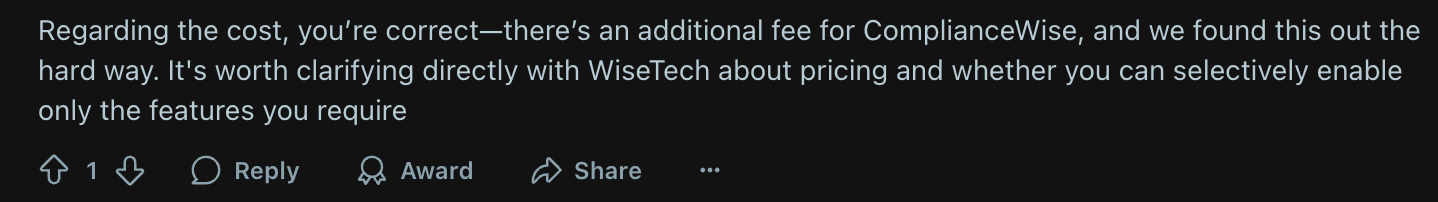

When WiseTech Global announced their new CargoWise Next product, they made a point of stating that it will come at no extra cost to customers. Sounds great, right? Sure, but if you read between the lines, although factually true, it was also quite the sneaky choice of terminology.

As I previously pointed out in last year's article and on LinkedIn (follow-me there for more logistics and supply chain insights, critiques, and some entertainment because if you aren't having fun then what is the point?!), the “no price change” wording is true for existing functionality only. And seeing as WiseTech Global's MO is to add functionality into the core product and then increase pricing…

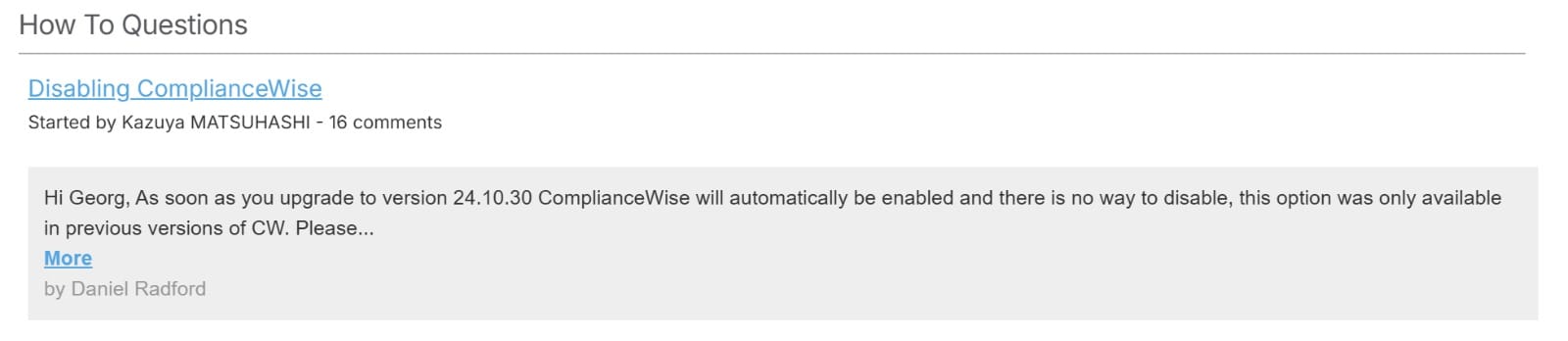

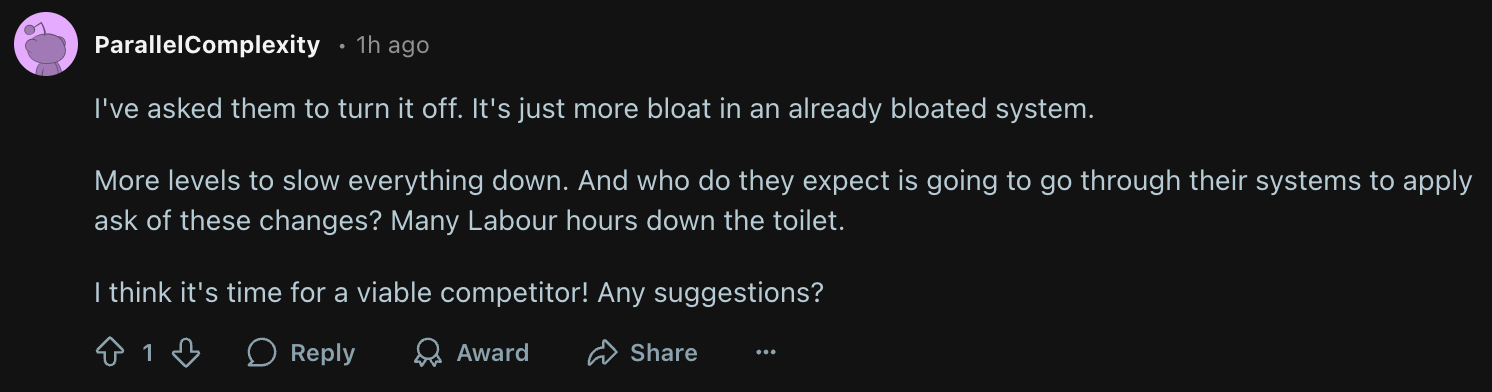

The above is the end result. ComplianceWise is one of two new modules, the other being Container Transport Optimisation. It comes as no surprise that they have made this a mandatory “always-on” piece of functionality. Do you hear that? No? Because I do. It is the sound of your hard earned revenue being funneled into WiseTech Global's big fat wallet. Feels great, doesn't it? The r/CargoWise subreddit loves it, as shown below!

WiseTech Global's Changing of Strategies on the Fly Scares me.

Just as we think it cannot get worse, it actually does. ComplianceWise was supposed to launch with the release of CargoWise Next, as they had said that no further functionality would be added to the existing version of CargoWise One. Since that statement back in August 2024, not only have WiseTech pushed back the release of CargoWise Next without advising their customers or their partner network, they have also released ComplianceWise for CargoWise One customers.

How should we interpret this? Is the new flagship product in such a sorry state that it has been pushed back long enough to merit them going back on their word? By releasing ComplianceWise onto CargoWise One, they have also gone back against their promise of not charging customers more for CargoWise One. Well, they didn't actually word it that way, did they? See what I mean about smart wording.

So, what should we expect now? Well, customers can expect another price hike, more feature bloat that cannot be switched off, and CargoWise Next to appear sometime in the next 5 years, maybe? At this point, it is anyone's guess, as their communications team is about as useful as their annual reports and earnings forecasts. Ouch.

Is CargoWise Still the go-to Solution for Freight Forwarders?

I am honestly starting to believe that CargoWise is only the category king because others have failed so hard. I will be putting together a detailed report on this space in the near future, including a number of providers, some of their history, and where we stand in 2025. Watch the space 👀.

If we look at CargoWise in a vacuum, the solution has a wide scope and is highly scalable. Sure, the set-up costs can be initially quite intense, especially when reliant on the WiseTech Service Partner network with the best partners in high demand and commanding a premium price point. Out of the box, CargoWise is not worth the added cost compared to the competition. Smaller forwarders can pick-up cheaper solutions, and with some excellent third-party niche software, build a great ecosystem for less, without having to deal with the unpredictable nature of CargoWise's pricing and product releases. At least that is the theory. To be confirmed.

Does Anything Compare for Highly Acquisitive Forwarders?

Now this is where WiseTech's true competitive advantage comes to light: the highly acquisitive forwarder. This isn't just valid for the mega-forwarders in the top 20 list, as there is consolidation across the top 200-500. I still strongly believe that for anyone making multiple acquisitions in rapid succession, looking to expand globally, WiseTech Global remains the best option.

DSV is the champion of this strategy, having acquired Panalpina, Agility, and soon to acquire DB Schenker, whilst using CargoWise. The speed at which they managed to roll out their CargoWise install to the acquired companies seems insane, and the benefits that they've managed to reap are nothing short of extraordinary. This is especially true when you consider that others, such as Kuehne+Nagel, judged these acquisitions as too expensive. When you have a solution that scales, you see value in a different way. The proof appears to be in the pudding.

But as with all good things, this relationship may have its limitations. How much are DSV parting with each month for CargoWise? Is it US$1mn? Or maybe US$2mn? Surely not US$3mn? As high as US$4mn? This data remains hidden away somewhere.

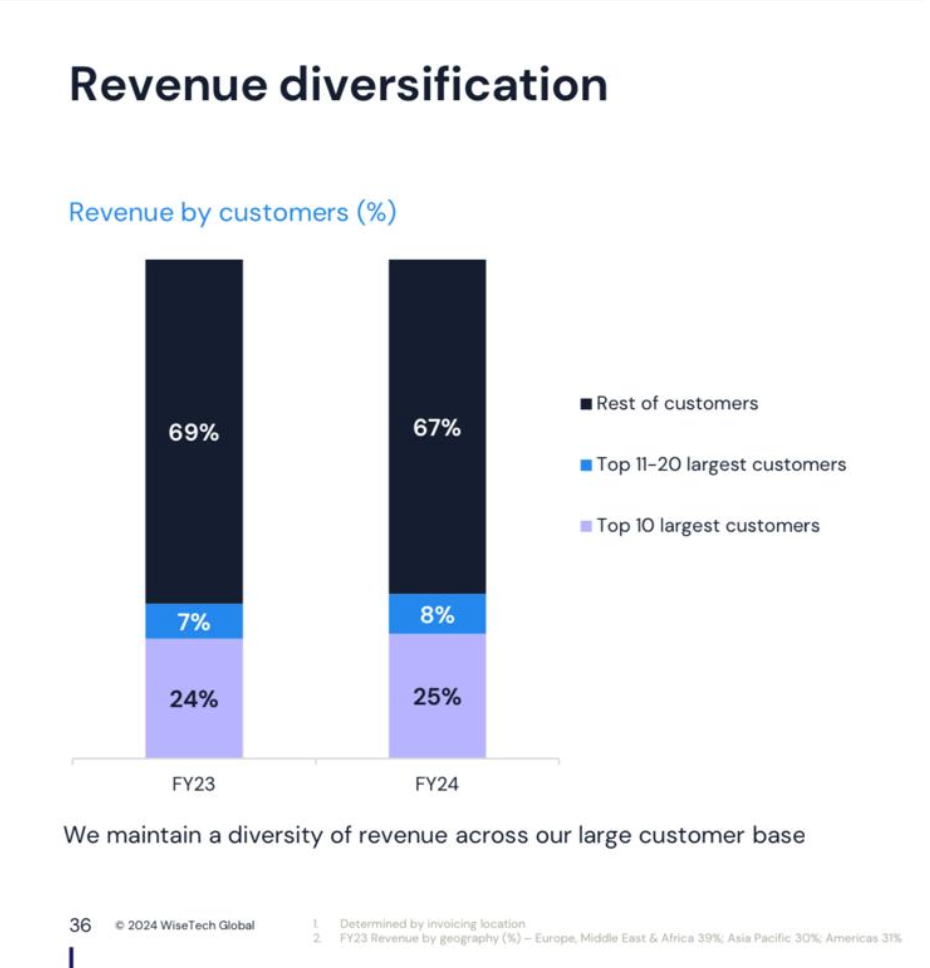

What we do know, is that WiseTech Global's revenue diversification has the top 10 largest customers sitting at 25%, so roughly AU$250mn give or take some. This would in theory put the largest customers, such as DHL and DSV, at somewhere between AU$50mn and AU$75mn annual spend, each.

When does this amount, the regular increases, the bloated functionality, and the total lack of accountability when it comes to product release schedules, become too much?

As mentioned in last week's newsletter on LinkedIn (link below), it may be time that DSV consider emancipation from CargoWise, especially if DB Schenker's existing solution does the majority of what is needed, even if it isn't as pretty. With advances in AI, and the plethora of third-party best in breed solutions out there today, DSV could build a truly special ecosystem based on Schenker's tech. This is even more relevant for three reasons that I believe true:

1 - DSV are going to expand in a big way into other markets and services, including US land freight, for which WiseTech has no product, and their US venture is floundering thus far (or so it seems)

2 - Now that DSV know what is needed for a post acquisition tech integration, they can clearly build what they need, including bespoke processes, and simple connectivity, to make it happen

3 - There are only so many potential acquisitions out there for DSV in the global forwarding space, and after Schenker, I believe that they will change things up and move into consolidating their position and optimizing what they have acquired

Plenty of food for thought.

Where Does WiseTech Go From Here and What is Next for CargoWise (Next)?

Am I still bullish on WiseTech's chances of becoming the “operating system for global supply chains”? Kind of.

With each passing year, the company appears to be less reliable, with a distasteful disregard for the interests of their existing customers, and partner network. Would it kill them to communicate better with those who actually attempt to keep the world's supply chains moving, rather than just looking to please investors twice per year with what can be described as bogus product release dates and curated announcements?

This is without mentioning their Global Customs Product that barely gets a mention now, and their questionable marketing practices that make them look as confused internally as we are when we see their video on WMS featuring CEVA Logistics, or their sponsorship of anything US-related in an attempt to salvage a US$400mn+ acquisition that hasn't provided any tangible results thus far.

I used to breathe WiseTech Global, well beyond 2021 when I stopped working there. And now, as 2025 starts to take shape, I cannot help but feel a sense of regret. Not for my time there, as I've said before, I think I arrived on the tail end of the good years, and left just as it started to go bad. I regret what the company is becoming, because unlike back in the second half of the last decade, they don't set expectations and then deliver on them. Instead they expect everyone else to move to the beat of their drum. And I say they, because behind the company, there is a leadership team, and they are the ones who consciously or not, continue to force their interests and desires on an industry and customers who are experiencing growing fatigue and burnout with all things CargoWise.

Will CargoWise Next actually have a meaningful rollout before the end of FY25 (by the end of June 2025)? - doubtful.

Will WiseTech continue to retain its customers with very little churn? - in 2025, probably. Beyond that - uncertain.

Will WiseTech change its ways and start communicating with customers, rather than talking at them? - No. Not without help and introspection.

My belief remains the same: WiseTech Global is in a race against itself. If they cannot deliver on meaningful functionality which continues to improve their customers’ productivity, resulting in cost savings and growth, then those customers will leave sooner rather than later. WiseTech Global needs to pivot into the BCO market, somehow retain their existing customers whilst continuing to increase pricing and not meet expectations, all the while fighting off newcomers and rivals of old, who smell blood in the water, and are ready to give forwarders new options.

Game. On.

If you've made it this far, thank you for reading all the way. As you can imagine, this content takes a while to put together, and I do it all alone (for now!).

In order to keep up the pace and quality (if I dare say so myself) of content, I am looking for sponsors, both for this and the LinkedIn newsletter. We're talking about reaching supply chain managers, founders, investors, and more, the world over. If you are looking the chance to support original thought and promote debate and discussion, let's talk.

If you really enjoyed the content, please subscribe (free), and head over to LinkedIn to read some more - drop a like or comment on my most recent post - it feeds the algorithm monster!