The Golden Era of Logistics Technology that never happened.

"We've always done it this way."

Now if that isn't the most dangerous phrase in business, I'm not sure what is.

What we've seen in the logistics technology world over the past decade is deeply rooted in that one phrase. This has proved costly for those providing the funding, and the companies signing-up to use the end result with high hopes. Aside from shattering many a supply chain professional's dreams of tech that actually helps them get their job done, what else has this era of lacking innovation done?

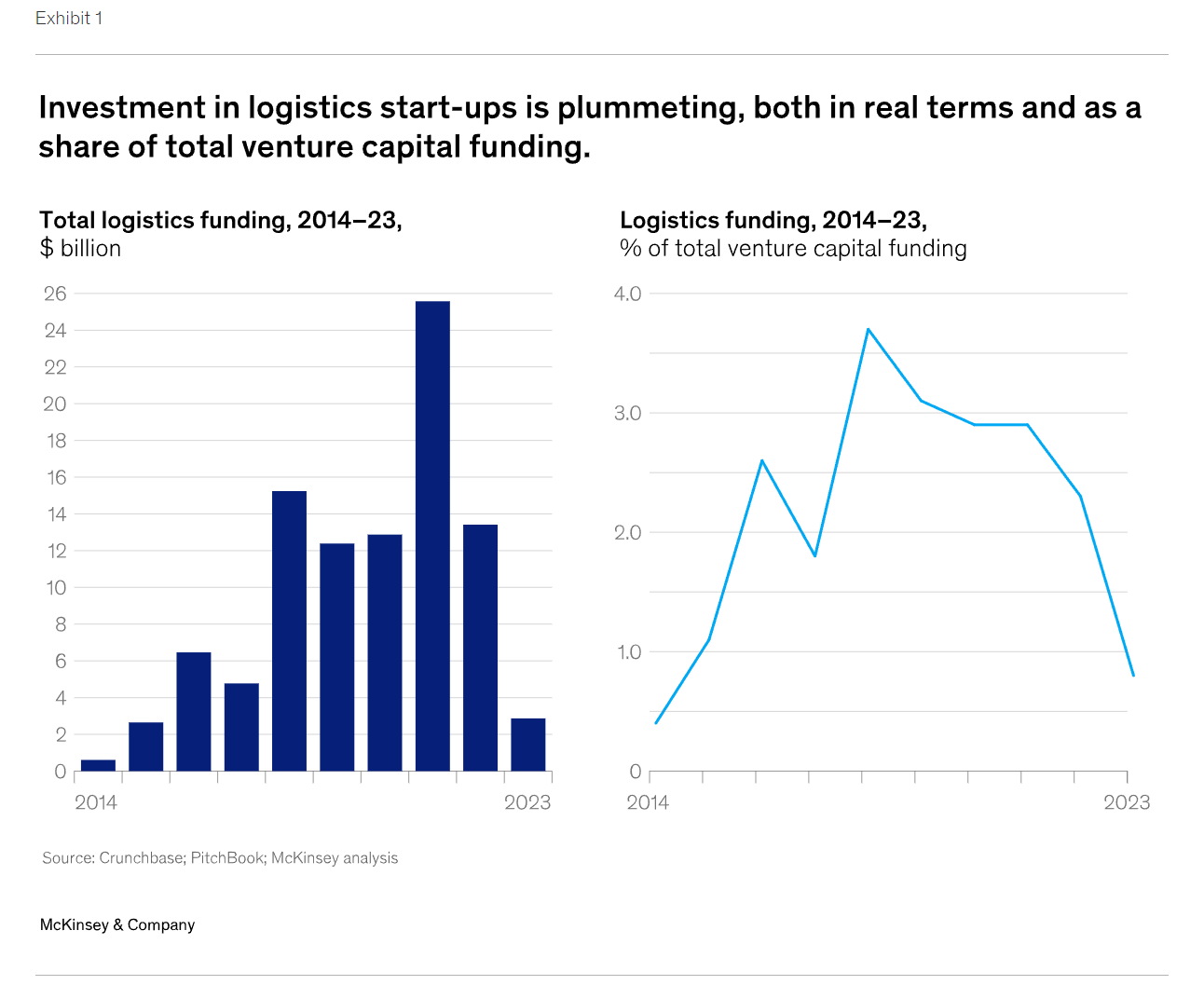

The VC money has dried-up, and interest in logistics seems to be at its lowest point since 2015 (according to McKinsey), but is all that about to change?

Logistics has scared the money away.

In case you missed the recent findings by McKinsey, here's a reminder.

- In 2021 logistics funding hit $25.6 billion

- In 2023 its down 90% to $2.9 billion

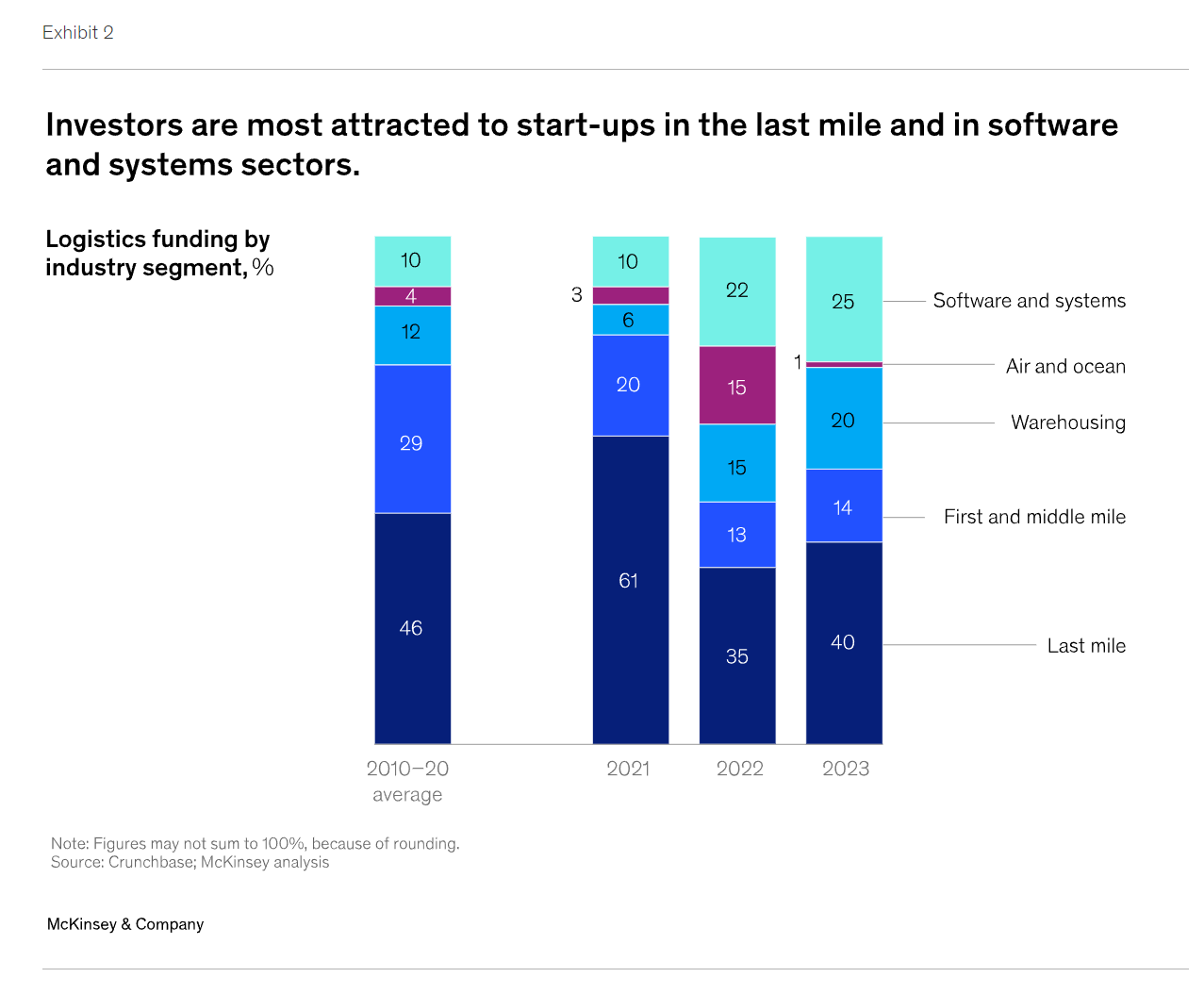

- The share of logistics tech increased from 10 to 25% of overall investment

- Logistics tech investment dropped from $2.5bn to $290mn

In the entire year, there was less investment in logistics technology than what Project44 received in 2022. That's not just a decline, someone started pulling the rug and have kept running away with it firmly in their grasp. I doubt that 2024 has been much better, with down rounds a common theme and VCs struggling to find winning ponies to bet on. And no, venture capital is not supposed to resemble gambling, but when you look at the recent track record in our industry, you cannot help but wonder if some people got lost on the way to the horse track.

Lacking innovation has consequences

There's only so much disappointment that customers can take before they decide to look for alternative ways of solving their pain. What should be the "Golden Age" for logistics technology is rapidly turning into a period of extended stagnation, after what can only be described as an overeager start. The money flooded-in, as did founders and executives from other industries. And yet innovation did not follow.

If the McKinsey numbers are correct, then logistics technology has received an average of 10% of logistics VC funding over the past decade. Where did the money go? Can you name one highly innovative, VC-funded, logistics technology success story? Tough one.

The Covid-19 pandemic increased logistics technology spend, as a wave of founders from other industries cycled-in to logistics and supply chain in an attempt to find fortune and solve problems with what they probably imagined were transferable skills and solutions.

Oh you sweet summer children, this industry provides for its people with enough work and potential to last a lifetime, but treat it like any other industry and you will end-up shell shocked.

Is it all down to hubris?

In a recent Everything Marketplaces interview, Flexport's rebound CEO Ryan Petersen launched into an opening salvo that I believe illustrates why we're seeing a huge lack of innovation and a large number of failed attempts at building logistics technology.

In the space of ten minutes, Ryan managed to cram in the fact that freight forwarders are expensive, have no technology, and that their people are mediocre. If these were the assumptions upon which Flexport was built, then it is no wonder that they company's valuation has tanked from $8bn to sub $2bn, now worth less than the funding they've received.

Click here to view the episode on Youtube.

Devil's advocate here, Ryan may have been quoting his thought process from a decade or so ago, but the problem is, these opinions have almost been a decade-long running joke in the industry, with many logistics tech founders taking them seriously today as they come-up with what they believe are solutions to "real" problems.

It is no wonder than founders who have had relative success in other industries, or have been a part of a successful start-up, saw logistics as a place to make a name for themselves.

"Logistics technology is antiquated."

"Logistics processes lack automation."

"Shipment visibility is bad and nobody knows where their goods are."

"The logistics industry is fragmented."

"Logistics systems are siloed."

These are just a few examples of what I can only imagine the majority of pitch decks are built on.

Some of this may be true, but much of it is nuanced. I've already covered some of the topics in detail, check out the rest of the newsletters here. The reality today is that the top 100 forwarders that Ryan mentions in this interview are tech-enabled, have great processes, amazing people, and for the most part, are wiping the floor with Flexport.

What's the current situation report?

The numbers do not lie, the money is gone. Some companies are managing to extend runway and survive by the skin of their teeth. Others are attempting to make their solutions seem more successful than they truly are by engaging in a number of proof of concept contracts with big names, hoping that it will be enough to bring in more money, or create a snowball effect.

The truth is, if your product is bad, there is only so much time you can spend grasping at straws before the straw starts to break.

The current reality for logistics technology is that the majority of companies out there have underperformed compared to their predictions and financiers expectations. We can name names and attempt to pin the blame of this wasted funding on individual founders and their lack of innovative ideas, or we can try to make sense of the greater picture.

Are logistics and supply chain processes actually to blame for the tech failings?

Of course not.

You cannot build tech and expect people to use it because it is recent, has a modern UI, and makes sense to the product development team and the CEO. This has been the problem for a while now that leads to today's current reality of underperforming technology that doesn't find product market fit. I've had high hopes for a number of solutions we've seen over the past couple of years, and yet the results have been mediocre at best. Some of them did have great UIs though...

What's happening with forwarders?

If they are in the top 100 list, chances are they are using CargoWise either as a global rollout, or for a specific part of their operations. Yes, I know, I do mention CargoWise often. The problem is, I talk about logistics technology, and the lack of innovation over the past decade has allowed them to thrive and take control of the freight forwarding tech landscape. This has made innovation even more difficult, as their system does not play well with third-party solutions. WiseTech doesn't play well with anyone if we're going to be brutally honest. They'll always figure out a way to price a new solution out of their customers' reach. Its quite impressive.

If you look at the top forwarders list... Kuehne+Nagel are using customs, DHL use CargoWise globally, as do DSV. DSV may acquire DB Schenker, leading to another sizeable piece of the pie for CargoWise. Hellmann, Geodis, CEVA, Bolloré... The list goes on. And those who aren't using CargoWise? Chances are, they'll be on it soon enough. I've often mentioned Nippon Express and their acquisition of Cargo Partner, a pre-acquisition CargoWise customer. Combined with their failed self-build of an air freight system costing them upwards of $130mn, I dare say they'll become a customer soon enough.

There are plenty of logistics technology start-ups out there that exist around CargoWise, providing complementary or even better functionality in the areas where CargoWise doesn't deliver. But those band-aid solutions are gradually being replaced by native CargoWise functionality, and frankly, they weren't all that innovative to begin with.

This situation, although great for CargoWise, isn't all that exciting for the shippers, who are looking for new ways to both reduce their freight spend, and transform logistics into an advantage. CargoWise know this, and are definitely making moves to accommodate this shift.

But where will that leave forwarders in the long run?

DIY logistics will drive tech innovation.

While forwarders are busy trying to find solutions to the problems not handled, or even caused, by their existing FMS, there is something else afoot. You see, for all the money invested in the past decade into logistics technology, there hasn't been much that has improved the forwarder to shipper relationship.

Flexport would once again argue this, but their legal battles with what I can only assume are most definitely now previous customers, beg to differ. I find it quite remarkable that Ryan Petersen would suggest that forwarders are bad at knowing where shipments are, when his own company is accused of wracking-up some interesting costs for their customers... People in glass houses and all that.

Can technology bridge the gap between shippers, carriers, the ports, and authorities?

The short answer: yes. But not without knowledgeable people and adapted processes. The greatest hurdle for shippers moving into DIY logistics and effectively cutting out the middleperson that is the freight forwarder is not technology. Between the general advances in connectivity and the desire on the carrier side to digitize and facilitate collaboration with stakeholders, tech is now a lesser concern.

But people and processes... this is where things start to become complicated.

There is a limited pool of knowledgeable and experienced people working in logistics. Amongst these specialists, some have a preference to remain in the consulting business due to the higher earning potential and diversity of engagements, further reducing the pool. In recent times, the heavily-funded tech start-ups, notably Flexport and its copycats, the visibility mafia, and a few other digital failures, attracted many people with the promise of lifechanging stock options and higher than average salaries.

For the most part, those stock options are pretty much worthless today, and those who have managed to retain their employment know that they could be a part of the next RIF. Whether operators, customer service professionals, sales folk, or on the technical side, these people are hungry for new opportunities, be that the chance of a large payday, or a more sustainable career path.

The final factor with an impact on the available pool of talent is the post-pandemic optimization and restructuring that is taking place in the forwarding world. We've seen the likes of C.H. Robinson and Kuehne+Nagel making changes (for better or for worse, time will tell), and I have no doubt that others will emulate these changes, hopefully in meaningful ways.

People and Tech enable logistics processes

To finish this line of thought we need to talk about processes. Without people and tech, processes are nothing more than somebody's imagination put into words and diagrams. We've established that technology is no longer holding BCOs back from Do It Yourself logistics. We've also just established that there is a growing pool of knowledgeable and experienced people looking for stability and a challenge. Seems to me that the stars are aligning, enabling more BCOs to DIY their logistics.

This will not be an overnight phenomenon, unless a tech company releases something special that, with minimal implementation pains and few internal resources, can completely replace the forwarder. The odds of that happening aren't exactly high, yet. In all fairness, this is what Flexport should have been. Its rather ironic that the company that has been most critical about "traditional" forwarders, has more or less transformed into just that. An expensive lesson to learn.

One thing to remember is that everything we're talking about here is for the larger BCOs. Those with the resources and time to start thinking outside of the box, ready to explore new ways of using logistics to their advantage. Small to medium-large shippers will most likely continue to rely on forwarders for a while yet.

The money will flow back into logistics, but not for the forwarders

Long sales cycles and difficult to displace incumbents have made logistics technology for freight forwarders a tough gig. Add to that the fact that the $200bn forwarding industry is very top-weighted, and you find yourself quickly fighting for POCs and scraps. Existing incumbents can also put up artificial barriers through pricing levers, or simply build competing functionality that is "good enough" to kill the majority of opportunities. We've seen this happen often, with the likes of Raft, Expedock, Logixboard, and Prompt Global, all having to pivot as CargoWise comes after them with NEO and whatever Bolero and Shipamax will become.

BCOs who choose to DIY their logistics however seem to have limited tech options. After having a number of conversations, it appears that the existing solutions are simply not good enough, too expensive, too clunky, or too focused on buzzwords and consultants rather than delivering a meaningful solution. Moving forward, this is where the opportunities are, and where the money should focus its attention.

Now is the time to start making moves

Why? Because unlike tech for freight forwarding, it is still early days for BCO logistics technology, and there are plenty of opportunities to solve real supply chain challenges that these companies face.

Why? Because it will only be a matter of time before the likes of WiseTech Global focus their sights on the BCOs, and when they do, their success at the top end of freight forwarding will be difficult to compete against.

Why? Because the likes of SAP are too busy chasing buzzwords and their certified consultants and partners are too busy dragging-out projects for increased revenue.

Why? Because although the likes of FourKites, project44, and Shippeo, have not solved visibility issues, nor have they provided consistently successful outcomes, they have shown that BCOs are ready to invest in technology in order to solve problems that should be handled by the forwarders and carriers.

Motive, means, and opportunity. What more do you need? Dust off that pitch deck, craft your BCO-centric story, and start enabling those with the goods to move them themselves.

Want more? Click the image below to access my LinkedIn profile and send me a connection request or follow for more content.

Since the last issue we're closing in on 9,500 followers on LinkedIn and have crossed the 650 mark on the newsletter, much appreciated. I'd like to take a second to mention that LinkedIn has completely destroyed the algorithm in recent time, reducing reach by 50 to 90% depending on the content and pages. Things will improve, but in the meantime, every comment, every connection, every piece of content shared, and every sign-up goes a long way. Thank you!

The next issue will focus on WiseTech Global's annual results and announcements. I'm expecting big things: new products, a move into the BCO world, a solid update for CargoWise, and some new customers (as mentioned in this edition, Nippon Express make a lot of sense).