A Warning to Software Founders Everywhere; a project44 Story. Ep. 2

No, you are not crazy. If you have a feeling of déjà-vu, that is because we were here no more than four months ago. project44 had just let go of 10% of its workforce, around 130 people, not long after being named a leader in Gartner's Real-Time Visibility Magic Quadrant.

This month is a similar story, on the back of being named 'Google Cloud Partner of the Year for Supply Chain & Logistics, they let go of 115 people. These are far from the only departures the company has seen in recent times, both voluntary and otherwise. There has been a slow bleed since their Movement product was announced, with a few larger rounds thrown in.

But why? What really happened at project44? Where, when, and how did they go wrong?

Will project44 ever find success, or is their fate already decided?

project44 Has Changed.

We all have our own definitions of success. And they change over time. Back in 2018, my idea of success was working my way up the ladder at WiseTech Global. Today, it is creating meaningful debate, having a voice, and initiating change. I'm not sure the two are mutually exclusive, but they are vastly different.

It's safe to assume that project44's views of success have changed since the early days. You can imagine the feeling of joy that the team there must have had with each new connection they built, and each gigabyte of data they managed to add to their machine.

Back then, in the pre-pandemic world, visibility was a rather novel concept. Forwarders were working to get goods from A to B without any real constraints from their customers, and the need for visibility and "real time visibility" especially, was only present for a select few who were looking to expand their competitive edge.

During the pandemic, success was acquisitions, accumulating logos, and good press. Success was an ever increasing valuation, investors patting the founder on the back, a fancy Champs Elysées office, and a private jet.

And then the penny dropped.

Success went from being adding new logos to trying to stop the churn. Raising funding turned into increasing runway. Thriving became surviving. Hiring became firing, again, and again, and again.

What is success today? I still believe being acquired for anything over 500mn would be a success. But that offer is likely no longer on the table, if it ever truly was.

The Beginning of a Success Story.

Go back to 2016 and you'll find a press release about their new downtown Chicago office, "built with stress relief in mind." This was on the back of their $10.5m Series A. Now this seems like a lifetime ago, with the leadership at p44 seemingly being the source of most work-related stress for their employees.

Scrolling through the different news items and press releases between 2014 and 2020, nothing seems out of the ordinary. The company continued to raise funds and grow at a strong pace, with expansions into European countries and integrations with tech giants such as SAP and IBM (SAP who now seem to be spending more time, and money, getting comfortable with FourKites and Shippeo).

It is safe to say that, looking back before 2020, project44 seemed to have all the cards, resources, and backing, to find success and build something innovative.

An Interesting Rivalry.

I'm a huge fan of the 'infinite game' mindset, coined by professor James P. Carse. The idea? "A finite game is played for the purpose of winning, an infinite game for the purpose of continuing the play."

I also believe that there is room for ego, even in an infinite game plan. Sure, it becomes orders of magnitude more complicated, especially when you're hooked on the dopamine hit that comes with every new press release and "small victory" (to not be confused with Jett's favorite "little v") you can get over your competition.

Enter FourKites.

Founded in 2014 just like project44, you'd be forgiven for believing that they did the same thing. Take the data from various sources, do something they call "AI-enhancement" or "powerful algorithms", and then provide it to the customer in the agreed format. Sure, this is a simple take on something much more complicated (or is it?), but you get the picture.

What I find interesting is that two companies that are seemingly providing the same thing have managed to coexist for nearly a decade. Even more interesting is that over in Europe, Shippeo was also founded in 2014 and is still trucking along today too. That's three companies, with more or less the same data, the same goal, and over $1.2bn in combined funding.

Once again it is worth highlighting that both Shippeo and FourKites seem to be doing better that project44 including the absence of layoff waves. Is it really the "macro" environment causing P44's struggles as their CEO stated in his latest Freightwaves column (does he own a stake in Freightwaves or something, I'm genuinely curious?)?

What Was The Plan?

We have to approach this believing that there was a plan at P44. Sure, plans change, but when you're managing a company with over a thousand employees and valued at $2.7bn at its peak, you have to have a plan.

From 2020 onwards, it looks like there was a shift in the way project44 carried itself. Does raising that much money really need to change your approach when you are already finding success? Or was it the Covid-19 pandemic that pushed them, as it did many others, to over-extend, increasing their spend and falling into a dangerous game?

As demand for real time visibility, fuelled by what everyone in the industry with half a day's experience and the ability to remove ego and hubris from their decision making process knew to be a temporary and rather artificially created demand, skyrocketed, so did their valuation.

But was there still a plan, or was the plan simply wrong?

Acquisitions with purpose, or to make a point?

Ocean Insights weren't the only company providing data. But they were an important one, and a supplier to the likes of CargoWise, and more importantly FourKites.

Did project44 need to acquire Convey, Ocean Insights, and ClearMetal? Probably not. If they were an essential piece to the problem(s) being solved by project44, then surely this would have propelled them to sustained new heights, and knocked their direct competition (FourKites and Shippeo) out of industry. So what was the purpose here?

This, at least to me, is where the long term plan (if there ever was one) was thrown out of the window. If ever you need a logistics technology example of when raising too much money goes wrong, look no further than project44.

"Project44 buys Last-Mile and Customer Experience Leader, Convey". The rest of the Press Release really drills home what is really important: logos, Gartner recognition, and having reached "Unicorn Status" (which lasted a whole five minutes). Convey's Founder and CEO Rob Taylor left after one year, and with the constant rounds of layoffs, just how many Convey "Customer Experience" specialists are left? It's important to note that at least one of the logos mentioned in the acquisition press release is a customer of a competitor today.

And then you have Ocean Insights. This one remains a mystery to me. Project44 already had access to the data, and did not need to acquire Ocean Insights for any reason other than posturing. Acquiring logos wasn't the play here, as most of Ocean Insights' revenue came from a small handful of companies that wouldn't even look twice at p44's offering. This acquisition was about harming the competition, and gaining an edge in the ocean visibility space.

The end result? FourKites and Shippeo are both still here today, and seem to be financially healthier than p44 judging by the lack of layoffs or office closures. I wonder if Mathew Elenjickal, CEO and Founder of FourKites, also has a private jet? Does Shippeo have a Champs Elysée office?

Unfortunately for investors and employees with stock options, charismatic founders often come with a strong ego, and without solid investors or a real board to keep it in check, things can quickly get out of hand.

Has Overspending Been a Common Problem at project44?

We've established that project44 had luxurious offices and a mode of transportation that would put Bernard Arnault or Musk to shame. But surely they did this as a profitable business with steady cashflow and a great situation, right?

Earners and Burners.

Back in late 2022, an article was published in the Australian Financial Review, mentioning the split in tech between 'earners and burners'. I'm not sure if Chris Bainbridge can claim to be the first to use this wording, but it clearly applies to the logistics technology space today.

There is no doubt that project44 is, and has been for many years, a burner. At the peak, their monthly burn was between $10 and $12.5mn. For a company that mentioned a 'contracted revenue' number of around $120-130mn, that simply doesn't make sense. At best, we can assume they were losing 30mn per year.

In those circumstances, the posturing mentioned above through the acquisition of Ocean Insights, the Champs Elysées office, and the private jet, just doesn't make any sense and sounds ludicrous. Was the board asleep at the wheel? Did Goldman Sachs decide that this was the decade they would continuously make terrible investment decisions and let the founders do ridiculous things? There is such a thing as bad publicity, just in case you were wondering.

There is no doubt that the burn rate has been substantially cut through multiple layoff rounds, office closures, and hopefully the sale of the jet (or the non-renewal of the lease). But will it be enough for them to survive in the current format, and for Jett to remain the CEO? I still believe he will be out by year end, under the overwhelming pressure of investors, the loss of his senior leadership team, and his failure to raise another safety net.

Launching Wrappers Instead of Innovations

I did have project44 on my radar for a while, and to be honest I was enthusiastic about their future as recently as early 2022. This really changed for me with the launch of Movement, their new flagship product launched nearly a year ago in October 2022.

As I'm typing these words, I'm rewatching the Movement product announcement, and wondering what truly went wrong with this product. The marketing was top tier. We're talking Apple levels of production value. The main problem here is that this product announcement was the peak for Movement.

This entire product was nothing more than a new wrapper. Nearly a billion dollars, half of which spent on acquisitions, and the end result was a whole lot of nothing. Not too bad for 8 years of work, right?

I'm about 10 minutes into the announcement, and the two staff members who have made an appearance thus far: Vernon O'Donnell the Chief Product Officer, and Q Carlson, the SVP of Design, are both no longer with the company. Not surprising considering that Movement is a total failure of a product. Described when announced as the culmination of the expensive (and potentially superfluous) acquisitions, and P44's existing products, it will quickly be downgraded to Jett's "little V" and later described as "achieving 1% of what they've set out to do". Why Jett ever thought it was a good idea to say such a thing after spending a billion dollars is hard to comprehend. Not sure where you'll find the other 99 billion you need to finish it?

What about the data?

Back in October 2022, one of the things I was very vocal about was the data. Even when Ali Akhtar, P44's VP of Data and Machine Learning (who is no longer with the company, that's 3 for 3), spoke about data, there were no insights into what this data was.

He presented a static dashboard which showed different pieces of information that they've decided are relevant and important to you as a customer. Sure, the lanes view is quite interesting, the question of "where does the data come from?" and "how precise is the data?" were never answered, even after asking multiple times.

Matt Dzugan, the ex-Director of Data Science did give some detail about AI and leveraging it in Movement. "Movement doesn't just know how long it takes to ship something from Shanghai to Chicago, Movement knows 10,000 ways to ship something from Shanghai to Chicago." Whether we're talking about forwarders or BCOs, they do not need 10,000 ways to ship something. They need precise exception management. They need to know when something will arrive, what is going wrong, or better yet, what is going to go wrong.

The data is the most important piece of this puzzle. No matter how you look at it, without good foundational data, you can apply all the AI and ML you want, you'll still have bad data at the end. By the end of October 2022, after asking these questions multiple times, and never receiving any real reply, including during an hour long call with the then Chief Product Officer and the President of Worldwide Field Operations Tim Bertrand. This call also happens to be the moment I really lost respect for project44.

Why was the question of "where does your data come from and how good is it?" mean everything? Because I was told by Tim via email that "we have spent the majority of the $’s connecting to carriers across various modes, geographies, etc". So nearly a billion dollars on connecting with carriers, and yet when asked, you cannot proudly and boldly shout it out loud with conviction?

Regardless, that product launch was a bad wrapper around an even worse product. Since its launch, project44 have not only let go of more than 20% of their headcount (I'm being conservative as they seem to hire between layoff rounds), they've also lost their CPO, CRO, Head of Sales, and more senior management roles. Not only do they not have a flagship product to lead with, but they have no leadership team to steer the ship.

No point dwelling on this topic further: the lack of clarity and beating around the bush says it all.

Losing Touch With Customers, and Staff

This will be the conclusion to what has been another interesting journey down the project44 rabbit-hole. There are now so many holes in this company that its dirty secrets are leaking like water through Swiss cheese.

Such is the amplitude of these leaks that they are now getting back to customers, prospects, and partners. On multiple occasions I've been asked if project44, or a company using them, is reliable and what are the risks? My answer is usually the same: why risk signing a contract and implementing a product that could disappear overnight due to the company's history of mismanagement and overspending, when you have viable alternatives that seem relatively healthier?

With Shippeo and FourKites seemingly doing well, and CargoWise having direct connections with the bulk of the world's ocean and air carriers, it isn't like P44 is the only option.

As for the staff at P44, I feel for them. We join these companies because we believe we will benefit from mutual success, and have a platform from which to grow.

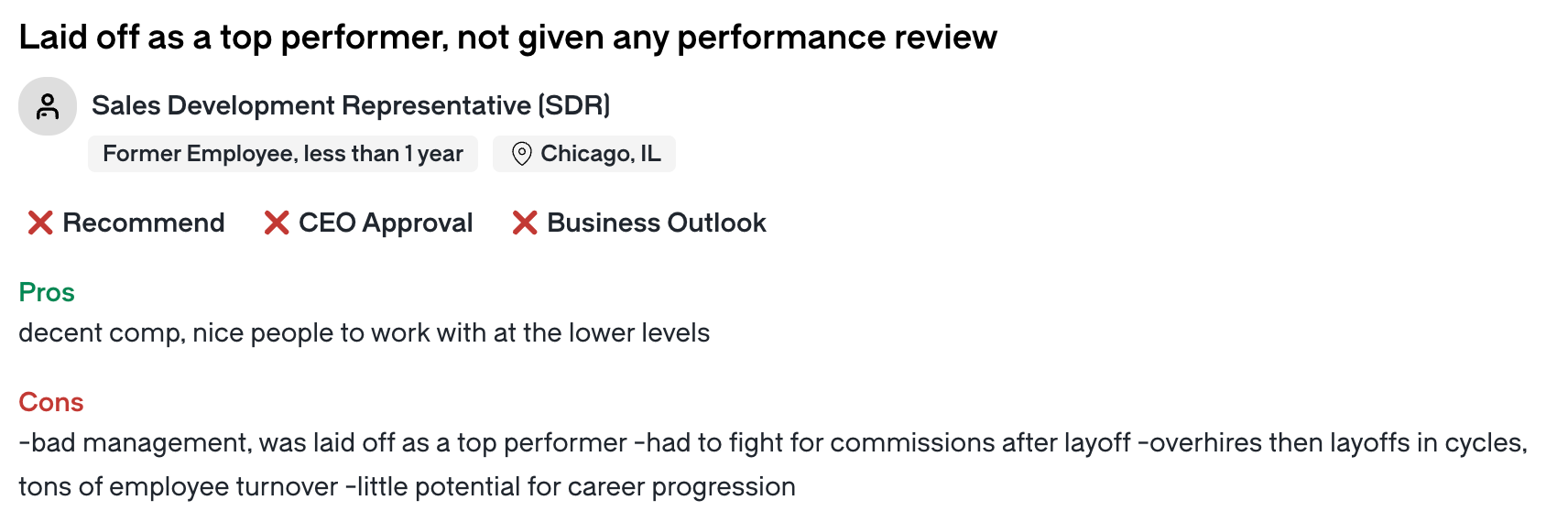

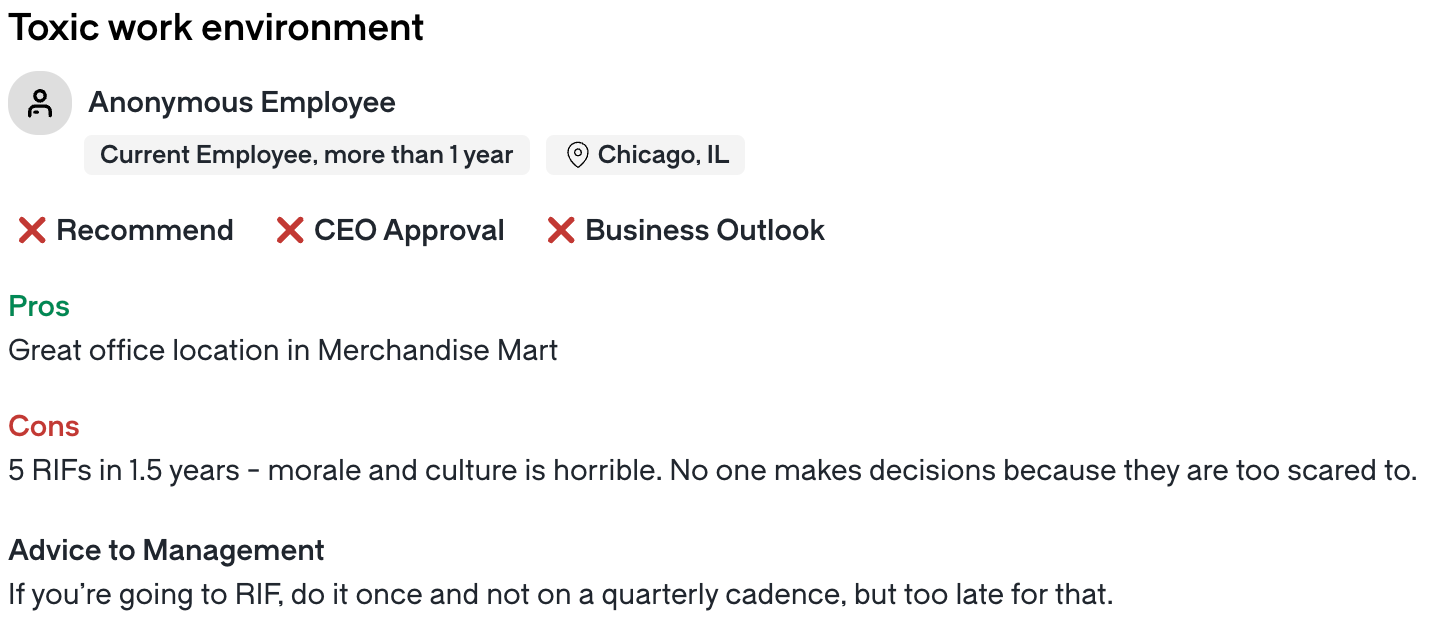

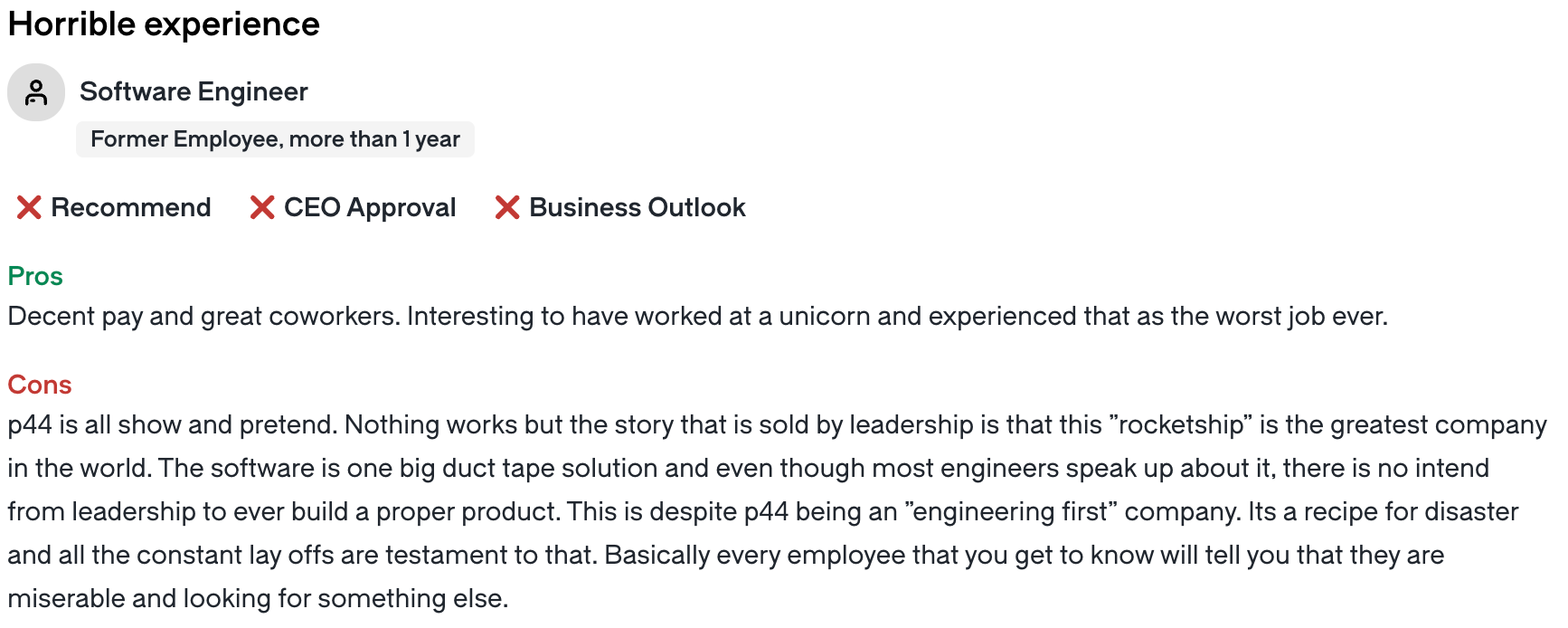

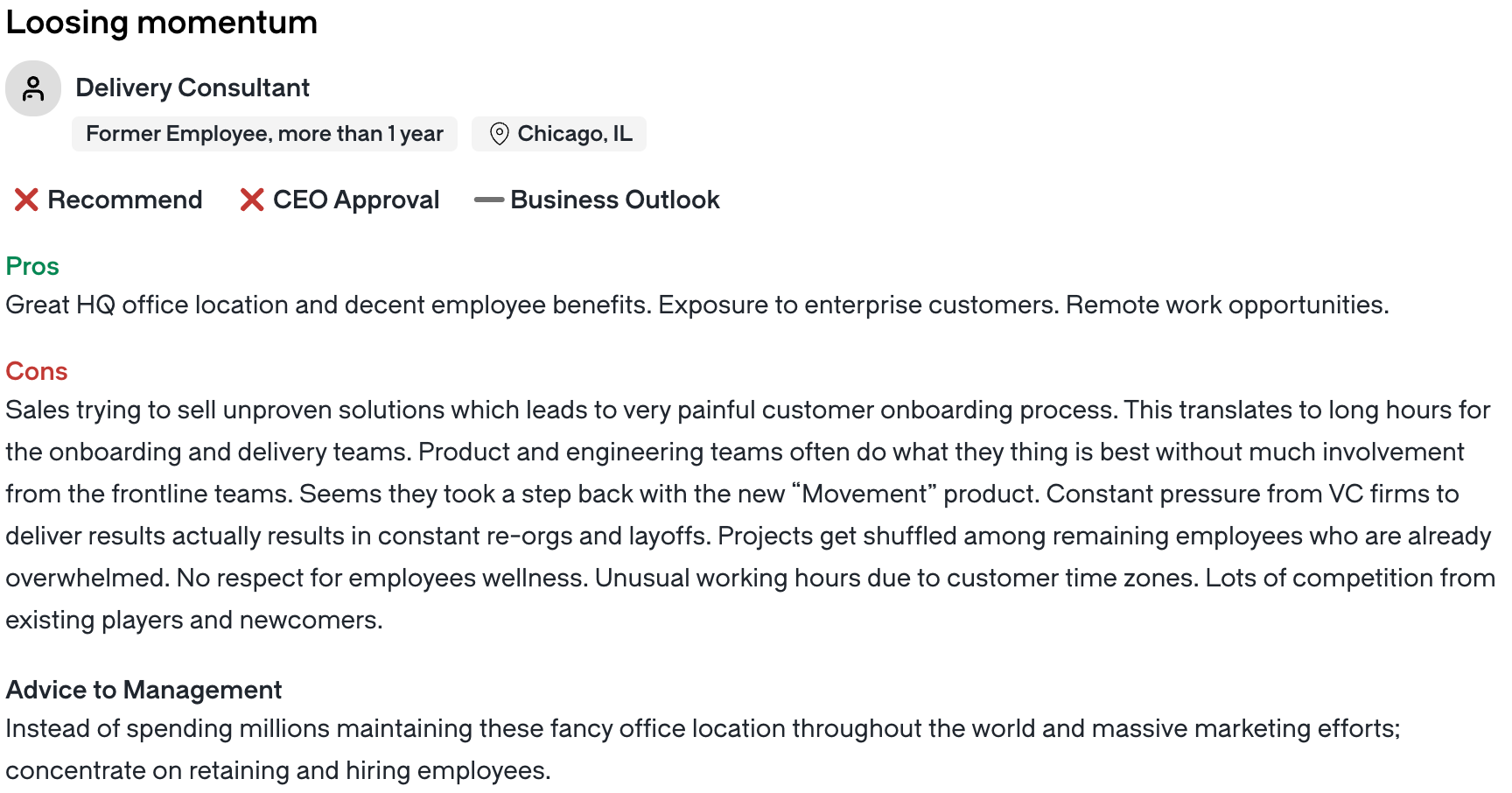

I'll close this one out with a series of screenshots taken from Glassdoor, and let you decide if you believe P44's leader can turn it around and deserves further support and more funding.

Or is it time he let someone else try to salvage something from this burning heap that cost nearly a billion dollars?

Hi, I'm Anthony, and I'm a bit of a Logistics and Logistics Tech Nerd. My opinions are my own, and I encourage you to share yours. Let's attempt to make Supply Chains and Logistics a more transparent and high-value place.

Catch me on LinkedIn for more regular updates between newsletters.