RTTVP is now scorched earth

Before “AI” was all anyone could talk about, another buzzword dominated the logistics technology landscape. This buzzword was, as all buzzwords are in logistics technology, used lightly, thrown around like a dog's favorite chew toy, thrust upon us so often that we grew very tired of hearing it.

Yes, I'm talking about “Real-time visibility”.

You all know what happened. Even before the Covid-19 pandemic, visibility was a growing issue in supply chains and logistics. The ever growing push for optimization in all things supply chain led to visibility slowly gaining in importance. And with good reason. If you don't know where your shipment is, how on Earth are you going to plan ahead? Succeeding in this industry relies on optimization and productivity.

Visibility is data, and data is the beginning and end of most successful supply chain stories. But not this time. This time around its a supply chain horror story. One so far fetched that you could sell the rights to Netflix for a three-part mocumentary featuring our favorite characters from the office and Ron Burgundy.

Real-time visibility is now scorched earth.

But. As with all things, this destruction leads to creation. We are seeing visibility appear in other formats, from other sources, and in new ways. The hype-train that was “real-time visibility” clearly left the tracks before arriving at the station, but this shouldn't impede efforts to provide true value in supply chain visibility.

Because we all know we need it.

The current reality of real-time visibility is sad.

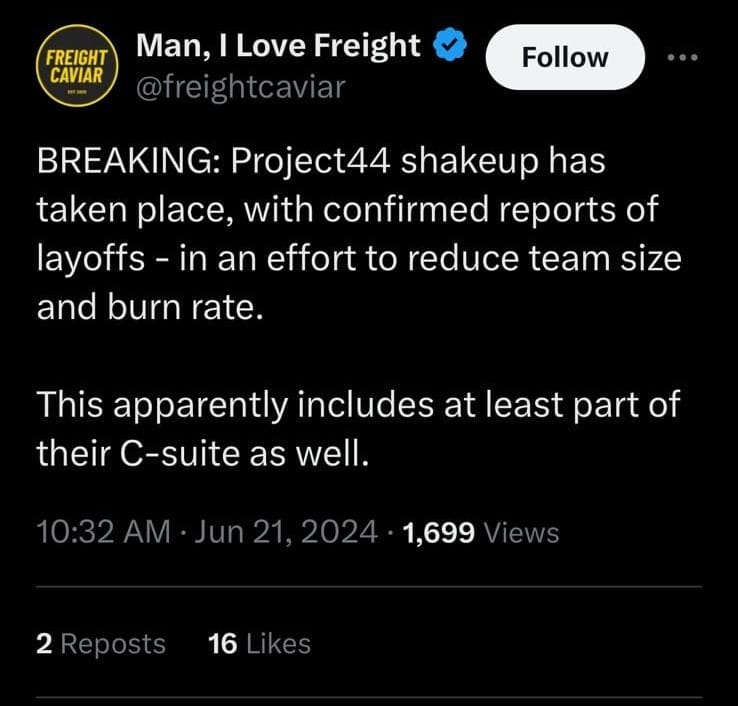

There isn't a snowball's chance in hell that I'll dive back into the rabbit hole that was Project44 over the past 24 months. From failed product launches to mass layoffs, private jets and flashy offices, the story writes itself and plays out like a bad episode of Mad Men or Suits. Well it seems that the private jet is no more and the flashy offices have been let go (along with a bunch of employees). If you want to revisit that wonderfully wild world, you'll find some posts of mine from last year here and here (enjoy!).

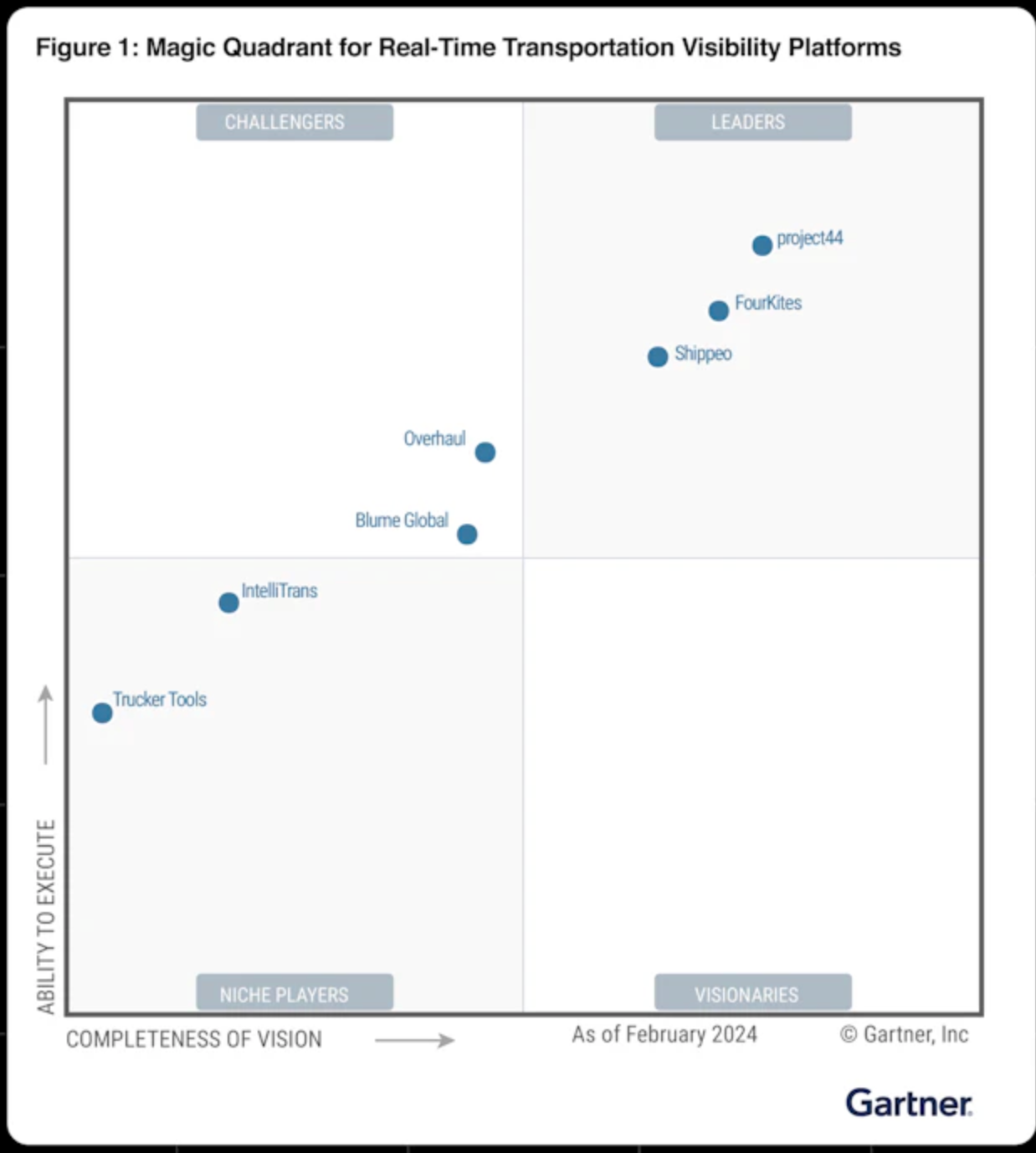

With the limited information available to us on the real-time visibility players, it is hard to define who is actually an earner. A great comparison would be putting Overhaul up there against P44. Overhaul have carved out a rather dominant position in a specific niche of real-time visibility that is truly “real-time” (or at least in theory). Overhaul's solution fits a specific purpose and doesn't try to overextend or overpromise (at least not yet). Overhaul do not seem to have splashed insane amounts of cash on ego driven expenditures such as fancy offices in prime locations or a private jet. If anything, they have been too QUIET over the past few months, something that I've pondered at length, expecting some kind of news any day now. I haven't seen their financials, but I'd put them down as an earner, and expect them to make some big announcements soon.

Project44 on the other hand… (I'll refer to my previous content here). They were a 10 to 12 million USD per month burner. Sure, we can assume that this has dropped drastically as they've been on a cost-cutting spree, but so has their revenue. The last time they reported ARR was in November 2022, a figure of $134 million. If my memory serves me well, this number was “contracted revenue”, or some other terminology designed to make it sound better than it actually is. Regardless, they were, and potentially still are, a major burner, despite announcing the recent 30% increase in revenue. Or was it sales? Does it really matter for them at this point? You can't really trust anything they publish without specific detail and clarity is my point. For them to succeed moving forward, they need to clear up their image, something they continuously fail to do.

When it comes to other major players such as FourKites and Shippeo, it is hard to imagine that they haven't been impacted in one way or another by Project44's antics. The word “real-time” appears frequently on FourKites’ website, and is used extensively on Shippeo's website too. Both of these companies line up directly against Project44, with a very similar offering. Their spending however appears to have been more controlled, and we can imagine that their respective financial situations are healthier than that of P44. Then again, when is anything ever rational? As someone who welcomes a healthy competitive environment, I'd like to see all three thrive by providing equally innovative and REAL solutions.

Oh Flexport you sweet summer child

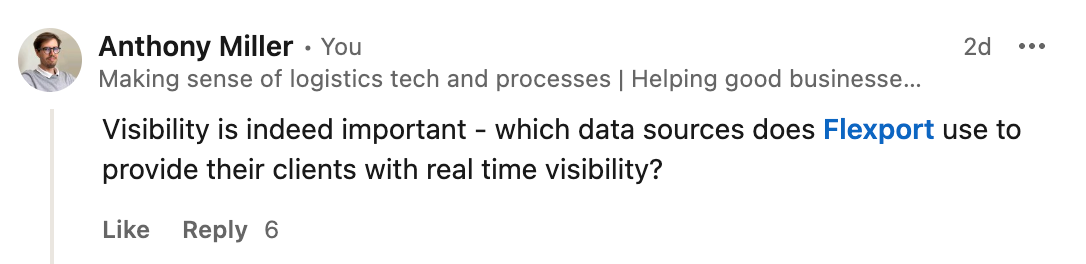

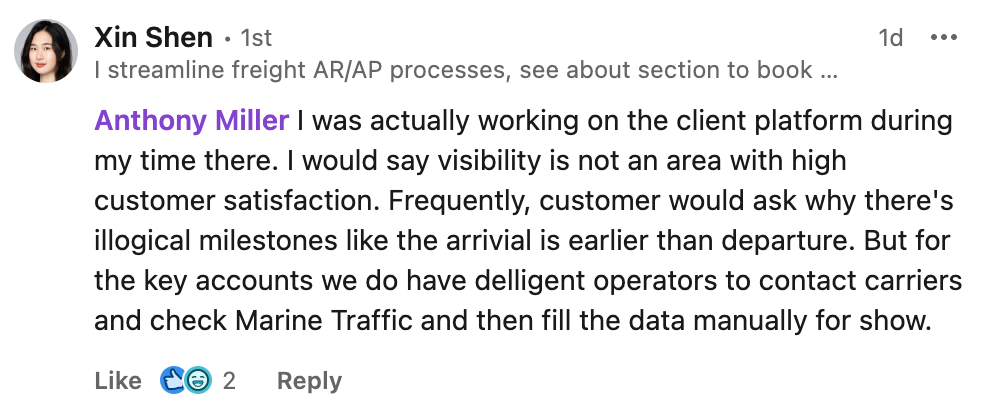

A recent comment provided by an ex-Flexporter (Flexonian?) perfectly illustrates what is wrong with current "real-time visibility" practices. This is a story I've heard time and time again: the data set-up is sub-par, so manual fixes are used for the most important customers, and the rest are left to deal with the issues.

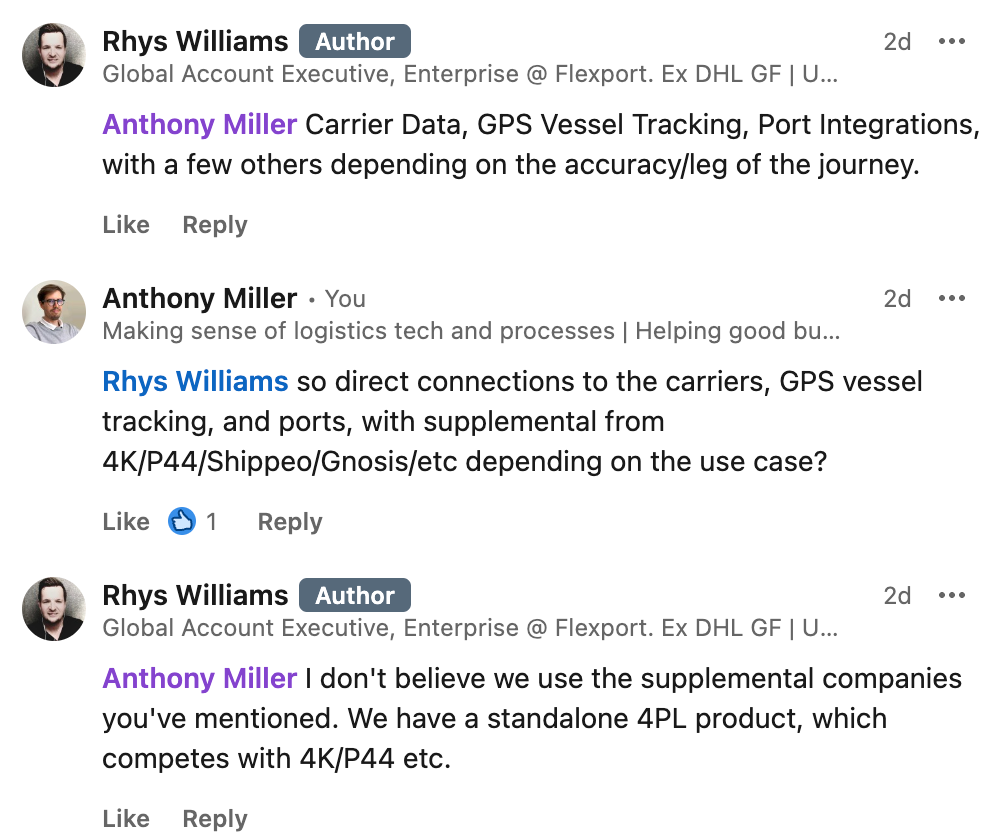

I recently put this question to one of Flexport's Global Account Execs. You can find a link to the post here. Pretty simple question, to which I was expecting a simple answer: carrier data, AIS, and then 3rd party such as 4k/P44 who claim to have the best data.

I'm curious what "depending on the accuracy" means. Surely anything other than "highly accurate" simply doesn't cut it. Regardless, the responses paint a very interesting picture. It appears that Flexport have build their own visibility ecosystem that works for them. Building direct connections and obtaining data that way is the hard way, but a commendable effort, and one that I believe in the long run will be the only way to constitute a true "visibility moat".

And then the moment it all came crashing down.

"For the key accounts we [...] check Marine Traffic and then fill the data manually for show".

Flexport, I think it goes without saying that this simply is not good enough. I do hope that this has changed since Ms Shen has left, but somehow I doubt that it is the case. So much for not using 3rd party data!

The big issue is that Flexport prides itself on being a modern solution for the modern company. Well part of the modern customer experience is self-service visibility via a front-end portal. There is also an expectation of reliable data, allowing customers to plan ahead and run an efficient supply chain. It is little wonder that both Giti and Peloton are taking Flexport to the FMC. If Flexport's system thinks your container arrived before it even left the destination port, would that not trigger free days and cause an ill-gotten accumulation of D&D charges?

New players have entered the game.

Truth be told I had already written-off visibility for the near future. I had accepted the fact that Project44's outrageous spending, along with the lack of innovation from what Gartner would call “RTTVP leaders”, had made the space unattractive and not worth exploring with the current technology available to us.

So what rekindled my interest and filled me with new hope for a sector so damaged by past indiscretions you'd expect everyone to have already jumped ship?

New blood.

When something is going fundamentally wrong, you need new ideas. They don't have to be fresh ideas. But they need to be new, different, from someone not already in the game. Visibility has seen its fair share of announcements recently, but others continue to fly under the radar. What are they waiting for? The cynical in me believes they are waiting for the rug to be pulled out from under the feet of the top 3 RTTVP players. The optimist? They are carefully curating a strategy, including product, go-to-market, and customer support, that will finally provide a reliable solution.

It's important here to go into some detail about reliability. There are some happy customers whom have found success with existing solutions such as Shippeo, Project44, and FourKites. There are also a rather sizeable number of unhappy ex-customers, and existing customers debating going back to market, due to unsatisfactory results. Ideally, any new solutions would have the right balance of cost, ease of implementation, functionality, accuracy, and result, all creating a sense of reliability.

Is that too much to ask for?

Burners vs Bootstrappers

Over the past 2 years, the majority of commentary has been about heavily funded companies burning money like there is no tomorrow. We've seen insane amounts of funding for companies such as Flexport and Project44, with nothing overly innovative or impressive to show for it, as least as things stand. Ryan Petersen himself said that Flexport had spent too much money. You can easily argue the fact that they raised too much, creating expectations that could never be met, especially for a company with one cheek on a tech chair and the other in the 3PL seat.

There is nothing wrong with finding funding for a great idea, nor is there anything wrong with spending that money to innovate and grow a successful business. But is that really what we've seen in logistics technology?

Not everyone is a burner. Earlier this year Kpler, who refer to themselves as “the leading global trade intelligence platform”, announced that they'd hit the $100 million ARR milestone. A milestone that project44 claimed to have reached in 2021 too. There are a couple of things that stand out to me and make Kpler all the more impressive: they were bootstrapped for the longest time, and they do not use confusing terminology such as "Booked ARR" or "Contracted Revenue", at least not as freely as P44 have done (press release).

“But what does kpler have to do with RTTVP and Project44?” kpler acquired Fleetmon and MarineTraffic in 2023. The potential marriage of cargo and vessel tracking is potentially a step in the right direction, providing BCOs with answers to their questions.

Kpler are keeping relatively quiet, and with good reason: unhappy customers and ex-customers are still licking their wounds after being oversold and underdelivered to. Take your time, get it right.

I do have to mention that what I have been told about Kpler has been far from meeting my expectations. So many great ideas and initiatives in our industry struggle to find success for the same reasons... When will the people who call the shots realize that a little humility and respect goes a very long way in this industry?

Here's to hoping they turn it around and release a very interesting solution that marries what they're known for with their new visibility resources.

The big ugly is coming for you

It wouldn't be a logistics technology article without talking about WiseTech Global. This year marks the 30th anniversary of the Australian logistics technology giant. Their flagship product, CargoWise, is starting to show its age (understatement of the year) from a UI and UX perspective. But there are many reasons it remains the freight management system of choice for major freight forwarders and 3PLs. You can read some of these in my previous post here.

Through sheer critical mass and pulling power, WiseTech Global has built relationships with ocean and air carriers that other companies could only dream of. It definitely helps when the likes of DHL and DSV can fight in your corner. Add to this Maersk and CMA CGM who both use CargoWise to some extent. The foundations are there for direct data access to the world's carriers. Add to this already promising picture the acquisition of Blume Global, and WiseTech are off to the races.

This may not be a huge deal yet, with CargoWise's visibility reach limited to their freight forwarder customers, but soon, the likes of Project44 and FourKites could be left wishing they'd had been acquired sooner. WiseTech Global clearly needs to find new markets and customers, one of which could be visibility for BCOs.

And we all know that when WiseTech Global sets its sights on something, nobody is safe: acquisitions, offers that cannot be refused, aggressive pricing, and expanded functionality that makes so much sense. Exciting times ahead.

What will it come down to?

We've found out the hard way that having boatloads of investor money and burning through it isn't a guaranteed pathway to success. If anything, of all the companies mentioned in this article, project44 is by far the one with the most egg on its face. Their rather hilarious feud with FourKites really gives things a midweek afternoon sitcom vibe that for some reason you just cannot stop watching.

If money isn't the key to RTTVP success, then what is?

Is it data? Yes, and no. Project44 acquired ClearMetal and Ocean Insights in an attempt to hamstring the competition. We all know how that worked out for them.

Maybe its scope? The market leaders and smaller players all claim multimodal capabilities, and yet there isn't a company out there that has consistently delivered on their promises.

RTTVP is still scorched Earth territory. A very difficult landscape to navigate. To find success moving forward, companies will need to show high levels of trustability, all the while spoon feeding results to their customer base. CargoWise is well positioned to do this as their solution is an all-in-one, potentially providing the same (or better) levels of visibility than the competition, without adding further screens and software to the mix.

My gut feeling is that WiseTech Global is waiting to see how things play out in this space before potentially doing some shopping. With direct data available from the ocean and air carriers, their focus should be on expanding land, starting with NA freight from Mexico to North America. Another key area where the importance of data is multiplied is at the ports. As with many things logistics related, the port landscape is disjointed and complex, with many stakeholders and different systems in play. Gnosis have started exploring with some levels of success, but overall customer satisfaction is yet to be determined and will not become evident until they either scale-up or disappear.

I strongly believe that there isn't enough room for Project44, FourKites, and Shippeo to coexist. If Project44 hadn't been so liberal with their spending and had a true strategy, they may have been able to acquire FourKites or Shippeo. Today, unless one of their financial backers has more money than sense, this seems impossible. In fact, I believe there is a greater chance that FourKites acquires Shippeo, or Shippeo makes a small acquisition of itself in an attempt to supplant one of the American incumbents.

Will WiseTech acquire Gnosis? Will Shippeo look to make a small yet impactful US acquisition to boost their expansion efforts across the Atlantic? Will Gartner finally grow some backbone and remove Project44 from the Leader quadrant in next years’ RTTVP MQ?

Many questions that are difficult to answer, and we haven't even touched on IoT, Tive's new release, or Hapag-Lloyd's new normal. One thing is for sure: this industry continues to amaze, both in good and bad ways. Change takes time, and I like to believe that big change is around the corner, but I know deep down, that meaningful change needs to be provoked. So let's provoke it.

Want more? Click the image below to access my LinkedIn profile and send me a connection request or follow for more content.

We're fast on track to hit 10,000 followers on LinkedIn and 1,000 free subscribers on the newsletter. I guess I just want to say thanks for reading, thanks for the support, and please let me know if you have any feedback - I want to make each piece of content better than the last.

See you in a couple of weeks for the next one, catch you LinkedIn in the meantime!