Gartner, We Need to Talk About What Makes a Leader.

Another year, another Magic Quadrant for Real-Time Transportation Visibility Platforms (RTTVP) served with no real surprises and a side-order of disappointment.

By now it is difficult to understand if Gartner actually has a grasp of what they are publishing, or if the content is simply put together and thrown out the door each year to satisfy their position as a point of reference in the tech space.

Incompetent, lazy, or actually a slippery yet smooth operator who bends to the will of the highest bidder? How do you choose to see Gartner?

How does Gartner make its billions?

Head over to your favorite search engine (or ChatGPT if you're one of those AI enthusiasts who has decided that having Arnold Schwarzenegger come after your kids in a couple of decades is worth it) and run a quick search on Gartner.

Gross revenue for the twelve months ending March 31, 2023 was approx $5.6bn, up 15% on the previous year. Yes, that's a sizeable number, and here's the source.

So how does the world-leading research and advisory company make its billions?

- Research: From what I've been able to find online, this is Gartner's largest revenue source. They provide research content available to subscribing clients, including a wide variety of reports and all the fun stuff that is usually 100 pages long and you just read the conclusion. This is where the second revenue stream comes into play...

- Consulting: Too busy to read the reports? Pay someone to read them for you and give you specific answers that may or may not suit your needs.

- Events: Gartner hosts some of the most popular events in IT and Tech each year. Their NA Supply Chain Symposium was a hit, and I'm expecting the same from the event in the EU next month.

- The other stuff: A plethora of tools, platforms, and services, such as their networking platforms.

Right, so we've established how Gartner is making bank. There is nothing wrong with having a sound business model, and Gartner clearly understands how to monetize its knowledge and upsell.

Let's say you buy a "Magic Quadrant" for $12,000. The most recent RTTVP report is 40 minutes of goodness, and 26 pages long. Don't understand it all that well? That'll be a $15,000 subscription to Gartner. Still confused or want deeper insights that may actually be of value and provide you with the knowledge you can't find on Google? That's a consultant. Very strong model from a business perspective.

Although having 16 pages explain your methodology and that being the only part that you may need a consultant to help you to understand is a questionable inclusion.

Regardless, is the knowledge on the first 10 pages any good?

The Magic Quadrant: Holy Grail of Gartner Reports

Inclusion and Exclusion Criteria that will have even the largest RTTVP providers calling their Gartner customer service rep to make sure they can be included.

Evaluation Criteria that seem to be applied at the discretion of the analyst.

Quadrant Descriptions that make absolutely no sense when you spend five minutes looking into the so-called "leaders" of some quadrants.

To my understanding, these are the three key parts that make up a Magic Quadrant. Why is this important? Because decision-makers use these MQs as guidance, or to provide some kind of confirmation bias. With great power comes great responsibility.

You're dropped, but we won't say why

Here is where things start to get tricky when looking at MQs and the way Gartner operates. Remember those billions of dollars the company brings in each year? How likely are their customers going to be to keep handing over fat wads of cash in exchange for consulting services and reports if they are painted in a negative way in a report?

Exactly, I don't need to answer that question for you.

With C.H. Robinson and FarEye being dropped from the MQ, I had to do a quick cmd+f search to see if there was any other mention of this in the report. To my surprise, there is no explanation, as usual.

"You are not good enough to be in the MQ, but we won't tell anyone why."

In fact, Gartner does one better and slaps a beautiful disclaimer there just to sweeten the blow. Like an ex-partner handing you a gift as they break up with you. "It's not you, it's me C.H. Robinson, I changed the MQ criteria and the market doesn't want us to be together anymore."

So we've established that Gartner is protecting its interests and sacrificing full transparency. Or potentially gating that reasoning behind a paywall that you'll need to pay 15k + consultant fees to knock down. Either way, it sucks.

If you're going to define criteria that make no real sense, at least apply them!

You can find my initial thoughts on the inclusion criteria over on LinkedIn - sure the post lacks detail, but you can get a sense of the raw emotion.

What I'd like to do here is focus on the Evaluation Criteria. When I was reading the list of evaluation criteria, I had one company in my mind: project44. Why them? Because if you're going to attempt to dissect and pick apart the processes used by a $5bn giant, you may as well look at who they deem a leader.

The Ability to Execute

For those of you who have never read an MQ before, this is the definition of this criteria, straight from Gartner:

"Gartner analysts evaluate providers based on the quality and efficacy of their processes, systems, methods, or procedures. This evaluation seeks to determine the extent to which they enable the technology provider’s performance to be competitive, efficient, and effective, and to positively impact revenue, retention, and reputation within Gartner’s view of the market".

In simple terms: can a company compete, survive, and thrive, based on how they operate?

We could answer this question with a very simple answer, but I'll leave things up to your imagination, and provide you with a question. Do you think a company that is unfundable, failed its star product launch and will be laying off more people before the end of Q2, ticks the above boxes?

Moving on...

This criterion has a few different sections, and this is where things start to get a bit messy and where you can question if the criteria are applied to each company.

"Overall Viability"

Gartner's definition: "An assessment of the organization’s overall financial health as well as the financial and practical success of the business unit. It views the likelihood of the organization to continue to offer and invest in the product, as well as the product’s position in the current portfolio."

Is anyone else hearing crickets right about now?

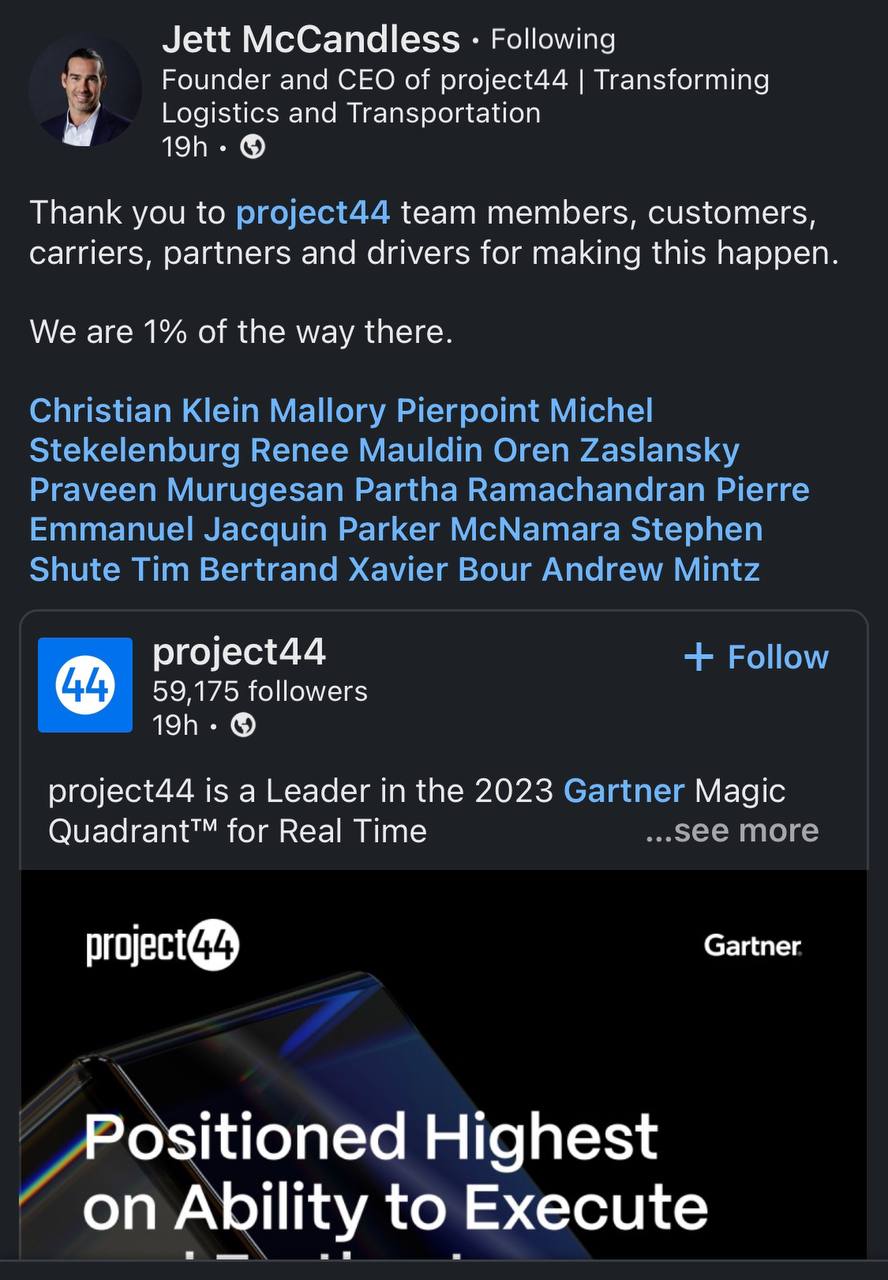

This is clearly the best place to include the following screen of P44 CEO Jett McCandless' post about being named as a leader in the MQ.

So after $1bn in investment and 10 years building what has led up to their "movement" platform, you're only 1% of the way there? Now call me skeptical, but I'm not sure there is any way you can raise or earn the other $99bn needed to get to wherever it is your "Big V" is hiding.

(I won't comment on SAP's CEO being the first person tagged on that post... Although I don't see many other companies that would be bold enough to acquire project44, and we all know they need to find someone.)

So to recap, a company that:

- Has raised $1bn

- Is now unfundable

- Is looking for a buyer or potentially an IPO

- Has failed their major product launch

- Has hired a new CFO and will likely be looking to cut costs and layoff people

Is considered financially healthy and of sound practical success.

Nice.

Quadrant Descriptions - the tip of the iceberg

Does the above-mentioned company sound like a leader to you? By all accounts a leader should at least be on a solid path to profitability, right? Surely a leader should provide unquestionable value to its customers?

According to Gartner:

- "Leaders have a compelling vision and a reliable Ability to Execute" (see above)

- "Leaders are innovators with compelling strategies for addressing the ongoing market changes..."

The goal of this post is not to bash project44 for its shortcomings. What they have achieved over there is nothing short of extraordinary. From the insane amount of funding raised, to the mouthwatering valuation, the huge marketing efforts, and signing deals with some very big names.

But somewhere along the way they went wrong. They stopped growing in a meaningful way, and instead of innovating or pivoting, they doubled down on smoke and mirrors marketing, and insane spending.

And Gartner has been witness to it throughout the years, without it having any impact on the MQ. Even now in 2023, with no profitability in sight, and a clear "noise campaign" in full swing, attempting to generate attention and interest for a sale or IPO... Gartner stands firm and elects such a company as the MQ leader.

This means either one of two things: Gartner factors in the impact of its MQ decisions on potential client reactions and spending in its money-generating activities, or the RTTVP sector is a place where funding goes to die, and customers seek answers to the right questions, but in the wrong place.

Hi, I'm Anthony, and I'm a bit of a Logistics and Logistics Tech Nerd. My opinions are my own, and I encourage you to share yours. Let's attempt to make Supply Chains and Logistics a more transparent and high-value place.

Catch me on LinkedIn for more regular updates: LINKEDIN

Listen to my most recent podcast appearance with Jonathan Kempe to find out more about me and some takes on our amazing industry: PODCAST